Can Africa repeat East Asia’s “miracle”?

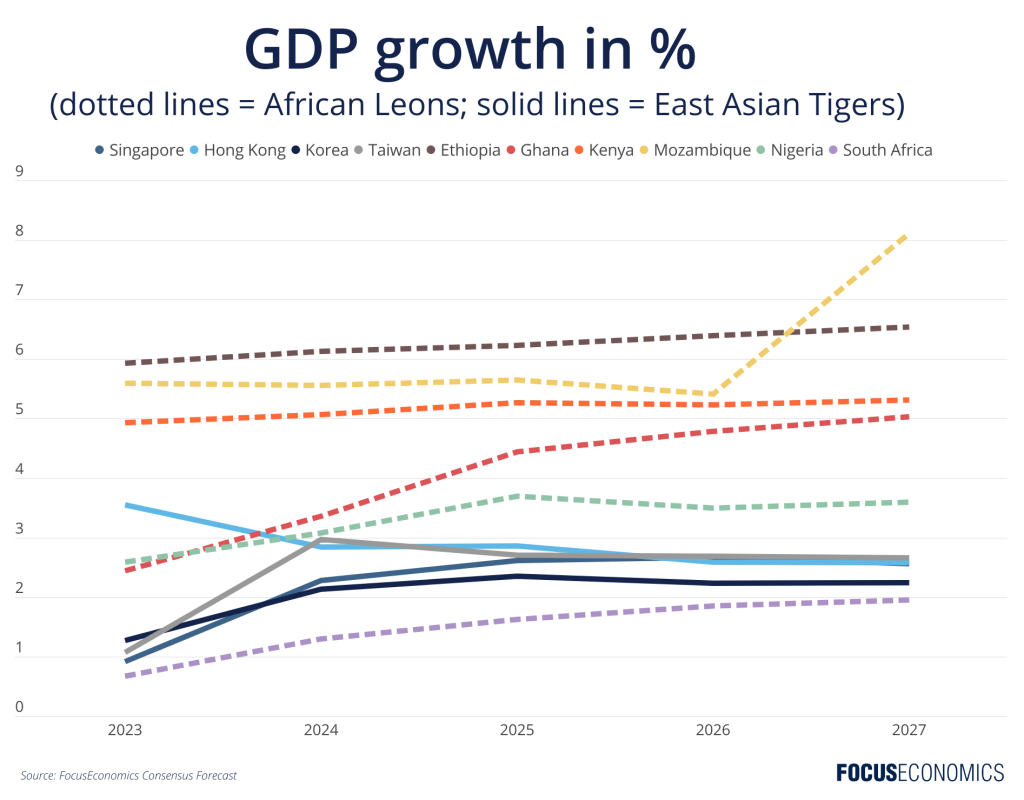

When highlighting Africa’s most promising economies, market analysts often point to the six “African Lions”: Ethiopia, Ghana, Kenya, Mozambique, Nigeria and South Africa. This epithet echoes that used to describe the Asian economies—Hong Kong, Singapore, South Korea and Taiwan—that grew at an eye-watering speed in the second half of the 20th century: The “East Asian Tigers”. But can the African Lions repeat the East Asian Tigers’ growth miracle?

The great divergence:

In GDP per capita terms, the African Lions have grown at a far weaker pace than the East Asian Tigers since the two began to diverge in the 1950s. By 2022, the average GDP per capita of the African Lions was around 5% that of the East Asian Tigers, with growth weighed on by weak institutions.

Our forecasts suggest no miracles, but great potential:

All but one of the African Lions is set to grow faster than all of the East Asian Tigers over the next five years, with the exception of South Africa. But this is no surprise: Lower income economies generally grow faster than wealthier ones due to diminishing returns on capital investment. The African Lions are expected to grow 4.4% between 2023 and 2027 on average. The East Asian Tigers grew nearly 10% in the 1960s and 1970s, when their GDP per capita was similar to that of the African Lions today. This suggests that the African Lions are unlikely to follow in the footsteps of the East Asian Tigers, at least for now, with weak institutions remaining a significant roadblock. That said, the African Tigers retain great promise economically, with deeper economic and political integration within the African Union—which was recently admitted to the G20 summit as a member—likely to play a key role if the continent is to close the gap with East Asia.

Insight from our analysts:

Analysts at the EIU are optimistic for Africa’s 2024 prospects:

“We forecast that Africa will be the world’s second-fastest-growing major region in 2024, just behind Asia, which will be propelled by China and India. Almost all African states will post a positive growth story, with war torn Sudan and struggling Equatorial Guinea the only economies that look set to contract in 2024.”

On external financing needs, Goldman Sachs’ Bojosi Morule and Andrew Matheny said:

“Tightening global financial conditions have resulted in a loss of international capital market access for frontier and/or low-rated sovereigns in 2023. This resulted in external liquidity pressures that in most cases (other than Ghana and Zambia) could be addressed with some meaningful but in our view quite feasible adjustments to demand policies, assuming that the global rate environment would ultimately revert to pre-Covid levels. But if we assume a persistent regime change — i.e., that higher-for-longer global interest rates are here to stay — these findings need to be reassessed.”