In our latest insight piece, we examine how the Eurozone’s key economic barometers—GDP, inflation, interest rates and unemployment—evolved in 2024, and what the Euro area’s outlook is for these indicators in 2025 and the next decade.

Current Economic Conditions in the Eurozone

Overview of GDP growth rates

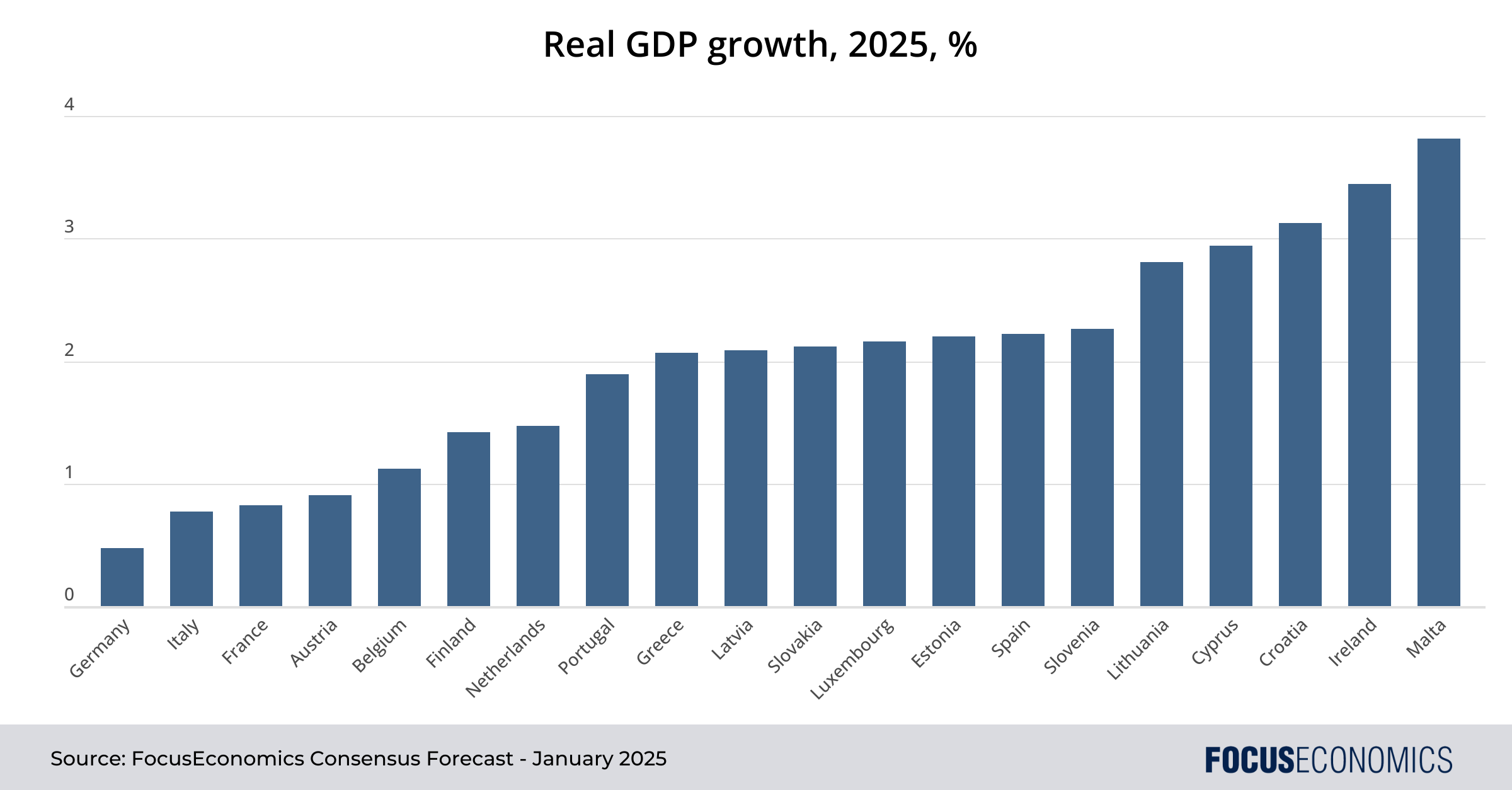

In 2024, the economic performances of Euro area countries varied significantly, and showed a clear regional trend. Growth tended to be stronger in the south, while some key economies in northern and western Europe contracted or barely grew.

This is partly because economies in the south tend to be poorer and so are greater beneficiaries of the EU’s recovery funds: For instance, Germany was allocated funds worth 0.7% of its GDP compared to 16% in the case of Greece. It’s also because economies in southern Europe tend to be more dependent on tourism—a sector that has grown strongly this year—and less on manufacturing, which hasn’t.

In particular, Germany’s once-mighty industrial sector is in the midst of a prolonged malaise, contracting for the third straight year in 2024. German industry is suffering from a slowing Chinese economy, higher global trade tensions, crumbling domestic infrastructure, and—most crucially—slow adaptation to new technological trends such as electric vehicles.

Inflation trends and their impact

As with GDP, inflation varied wildly among Euro area economies last year, averaging above the European Central Bank’s 2.0% target in most countries. At one end of the spectrum were countries such as Belgium and Croatia. Belgium was the only Euro area country to see higher inflation in 2024 than in 2023, due to the expiration of government measures capping energy prices. Meanwhile, Croatian price pressures were spurred by strong economic growth and higher visitor arrivals, as the country benefited from its incorporation into the passport-free Schengen area.

At the other end of the spectrum, Finland and Lithuania saw sub-1% readings, with inflation in Finland in particular capped by the weak economy. Looking at the currency bloc as a whole, inflation was far lower in 2024 than in 2023 due to lower commodity prices and tighter monetary policy. This, in turn, supported real wages and private spending.

Interest rate trends and their impact

In the face of lackluster economic growth and falling inflation, the ECB cut rates multiple times last year, with the deposit rate falling from 4.00% to 3.00%. The impact of these rate cuts should become more apparent in 2025 as lending rates to consumers and businesses continue to adjust downwards.

Unemployment rates and labor market dynamics

The labor market was a bright spot against an otherwise uninspiring economic backdrop last year. The unemployment rate declined to a record low in the Euro area as a whole amid strong services activity, and real wage growth improved as inflation declined. That said, the divergences among member states remained stark, with the lowest unemployment rate—that of Malta—almost four times below that of Spain, the country with the highest rate. Myriad factors explain the divergences, including differences in contract types, back-to-work policies, immigration rates, and economic growth. In the case of Spain for instance, unemployment has long been chronically high due to stifling labor market regulations.

Challenges facing the Eurozone economy

Geopolitical risks and their economic implications

When it comes to geopolitical risks, none appear more pressing than the possibility of higher U.S. tariffs on European goods. In the first 11 months of 2024, the EU ran a trade surplus in goods of over USD 200 billion with the U.S.—a figure Trump has promised to reduce through tariffs. Such an outcome would hit the bloc’s already ailing industrial sector, particularly the manufacture of chemicals, machinery and vehicles, which account for the lion’s share of shipments to the U.S. The EU would be likely to retaliate in turn, raising prices for European consumers. Higher U.S. sanctions on the rest of the world are another downside risk, albeit less significant than direct sanctions on the EU itself. Such a scenario would weigh on global demand and consequently appetite for EU goods and services.

Nomura analysts said:

“We expect the US to apply blanket 10% tariffs on imported goods following the election of Trump, and we believe the European Commission will retaliate like-for-like, which could mean higher inflation across Europe. However, with manufacturing firms’ pricing power having greatly diminished, firms will likely be compelled to absorb some of these higher costs, which in turn may result in lower profits, some firms shuttering and unemployment rising. This effect could weigh additionally on growth. With the euro area imports from the US equaling just over 2% of GDP, 10% retaliatory tariffs could add 0.1pp to the GDP deflator. Hence, we believe the direct impact of US tariffs on Europe’s inflation will be minimal, particularly when compared with the impact on its growth.”

Russia’s war in Ukraine is another factor to watch. While the conflict’s spread to other European countries is not likely, such an outcome would pose large negative risks to economic growth. On the flipside, a peace deal could lead to some sanctions relief on Russia, boding positively for European growth.

Other potential conflict hotspots are the Middle East between Israel and Iran, and a Chinese invasion of Taiwan. War between Israel and Iran could choke global oil supply, while a Chinese attack on Taiwan would be by far the more dangerous for the Eurozone as it could morph more easily into a global war.

EIU analysts said:

“China has escalated military pressure through intensified People’s Liberation Army (PLA) exercises and harassment of Taiwan’s outlying islands, such as Matsu and Penghu, and Taiwan is struggling with internal political gridlock following the 2024 elections. These pressures heighten the risk of a miscalculation, particularly as Mr Trump’s administration is expected to respond with stronger military commitments to Taiwan, including naval patrols and arms sales. This dual-track confrontation—trade and Taiwan—creates significant risks for regional stability and global supply chains, highlighting the importance of scenario planning for corporations operating in Asia.”

Structural challenges within member states

Slow adjustment to emerging technologies: The competitiveness gap with its global counterparts, particularly the United States and China, is arguably the major structural challenge facing the Euro area today. While Europe once led in many industrial sectors, it has struggled to capitalize on recent technological revolutions, in IT, the shift to electric vehicles, and—most recently—AI. For instance, Europe houses only four of the top 50 global tech companies, and its share of global tech revenue fell from 22% in 2013 to 18% by 2023. European companies underinvest in R&D, with a EUR 270 billion annual gap compared to the U.S. Fragmented markets, a lack of venture capital funding and regulatory barriers stifle innovation and the scaling of start-ups—many of which end up crossing over to the U.S. in order to continue expanding. The upshot has been lagging productivity growth in the EU: Since 2000, hourly productivity in Europe has grown at an average annual rate of just 0.8%, half the pace observed in the United States. This has in turn fed through to a widening income gap between the U.S. and Europe.

Goldman Sachs analysts said:

“As the investment gap widened, Europe has lost more of its market share in global trade. Since the pandemic’s effects began to be felt the global economy, the Euro area market share of global exports has declined by an additional 2.5pp and more of its trade flows have been directed toward the US. Meanwhile, China has been gaining an almost equivalent share to what Europe lost. […] While we believe additional policy support for investment would be key to underpinning the European economic recovery and addressing the structural investment gap with the US, […] it is unlikely, in our view, that the EU will be able to scale up funding unless pro-European integration parliamentary majorities emerge in both Germany and France, postponing the potential adoption of the more costly investment support.”

ING analysts said:

“The highest R&D expenditure in Europe is still made by car manufacturers. Sales in that sector are under pressure and competition from the US and China has increased sharply. The same applies to the machinery industry, where ASML is the exception to the rule, partly due to a strong, long-standing commitment to R&D and a fast-growing high-tech sales market. The telecom sector – another major grower in terms of productivity – has also made great strides, but in Europe, compared to the US and China, it still consists of many, relatively smaller players. Cross-border consolidation for economies of scale has proven more difficult in Europe.”

Energy: High energy costs remain a significant competitive disadvantage for Europe, with electricity and natural gas prices for EU companies being 2–3 times and 4–5 times higher, respectively, than in the U.S. This disparity, exacerbated by the loss of Russian pipeline gas, hinders industrial output. As with broader competitiveness challenges, a key disadvantage faced by Europe compared to the U.S. is a fragmented internal energy market, in addition to excessive reliance on imports. Moreover, while Europe’s ambitious decarbonization targets offer opportunities in clean-tech leadership, they also expose industries to higher upfront investment costs, and Europe is facing tough competition in the clean-tech space from China. Chinese firms now dominate the solar market for instance, despite European firms having had a first-mover advantage. The EU thus faces the dilemma of allowing the unfettered import of cheap Chinese green technology in order to reduce energy prices at the cost of weakening the domestic renewable-energy industrial base.

Demographics: Demographics are another problem area. By 2040, the EU’s workforce is projected to be decreasing by nearly 2 million annually, lowering the worker-to-retiree ratio from 3:1 to 2:1. This demographic trend means that productivity will need to do the heavy lifting as the primary driver of economic growth. Without increased productivity, the EU’s economy could stagnate and struggle to fund the necessary investments in decarbonization, defense and digitalization, while straining pension systems and healthcare. Without a marked improvement in productivity, taxes will likely need to rise to account for greater age- and health-related spending.

Future Economic Projections for the Eurozone

Short-term vs long-term growth forecasts

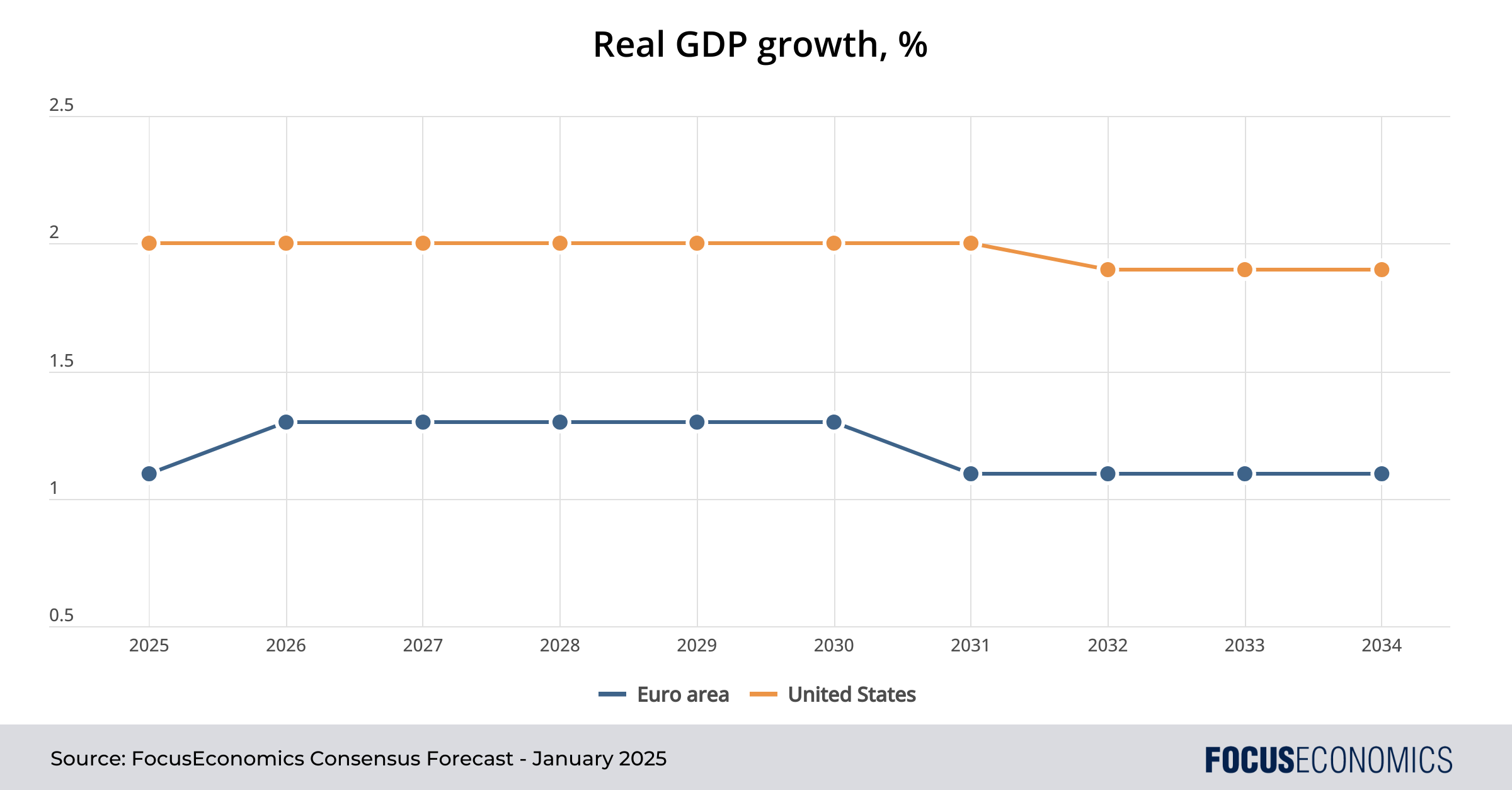

In the short term (2025), our Consensus is for monetary easing to feed through to slightly faster Euro area economic growth vs 2024 of around 1%, though this will still be around half the corresponding figure in the U.S. This disparity will persist in the coming years. Over our forecast horizon to 2034, our panelists expect Euro area growth to track between 1.1% and 1.3%, while the U.S. is seen expanding close to 2% per annum. This underperformance relative to the U.S. reflects both Europe’s weaker demographics and likely softer productivity growth in the coming decade. Looking at individual economies this year, the picture will remain similar to 2024, with southern Europe outperforming the north, and Germany remaining a regional laggard.

EIU analysts said:

“Poor demographics, a public investment deficit compared with peer economies, pressure on competitiveness from energy prices and high exposure to an increasingly complicated trade relationship with China will continue to limit German growth. The picture is also weak in France, with GDP growth set to slow marginally to 1% as political turmoil hampers business and household confidence, and external demand from major trading partners (including Germany and Italy) remains sluggish.”

Expected inflationary pressure

Despite lackluster growth projections, our Consensus does not see a return of the deflation that dogged the economy in the 2010s. Euro area inflation is forecast to remain close to the ECB’s 2.0% target over the next decade, propped up by the greater fragmentation of global supply chains, rising protectionism and labor market tightness. This in turn will stop the ECB from reducing interest rates back to zero, as they were pre-pandemic. Our Euro area interest rate forecasts are currently for around 100 basis points of cuts this year, with the deposit rate to then settle at close to 2% in coming years.

ING’s Carsten Breski said:

“At 3%, the deposit interest rate is still […] too restrictive for the eurozone economy’s current weak state. The recent surge in bond yields has also worsened financial conditions in the eurozone. […] While the experience of being slow to address rising inflation will deter the ECB from adopting ultra-low rates, the desire to stay ahead of the curve remains a compelling reason to return interest rates to neutral as swiftly as possible. This means that the ECB will continue to cut rates. Bringing them at least to the upper end of estimates for the neutral interest rate, i.e. 2.5%, seems like a no-brainer. However, if the eurozone economy remains weaker than the ECB’s December forecasts predict, cutting rates further will become unavoidable.”

Unemployment projections and workforce trends

Our panelists see the Eurozone unemployment rate continuing to trend down and plumb new record lows, but remaining above corresponding figures in other developed markets such as Japan, the UK or the U.S. due to structural labor market rigidities in some countries, especially France and southern European nations. The Euro area’s demographic profile will continue to age, with a shrinking workforce and slowing population growth.

Goldman Sachs analysts said:

“We expect the contribution from labour to decrease from +0.2pp currently to a small negative by 2030. The key reason for this is that we expect the recent strength in net migration and labour participation to moderate over the coming years. In addition, we expect ageing demographics and a decline in average hours worked to continue to exert a drag on labour input.”

Originally published in January 2025