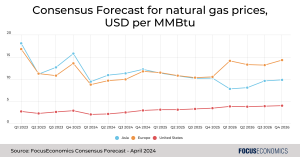

Natural gas prices spiked in 2021–2022 to the highest levels since the financial crisis. They have since declined, but the bumpy ride for consumers of the fuel—households, businesses and investors—is far from over. The specter of wider regional wars in both Eastern Europe and the Middle East continues to threaten supply. And amid all this, the economies of gas giants Qatar and the United States have seen their LNG export volumes mushroom in recent years. In our latest special report, we polled leading market analysts on the outlook for the natural gas market over the next five years.

In 2024, natural gas prices are set to dip

The forecast for natural gas prices in 2024 is for falling prices in Asia and Europe from 2023, and for prices to remain broadly steady in the U.S. In all three regions, inventories are much fuller than normal, weighed on by mild weather, weak industrial production and a move to renewables. These factors are set to keep driving down prices in 2024.

In 2025, prices are set to rise

The Consensus is for natural gas prices to rise in Europe and the U.S., exceeding the 10-year pre-pandemic average in both countries. In Asia, prices are set to remain stable, while still beating pre-pandemic averages. El Niño, which boosted temperatures last winter, is not expected to return next year, raising heating demand as a result. Rising industrial output and continued Western sanctions on Russia will further stoke prices.

But risks to the outlook remain

One such risk detailed in our natural gas report is the Biden Administration’s recent freeze on new LNG export licenses. However, the ban could soon be undone, with recent media reports suggesting that the Republican Speaker of the House of Representatives, Mike Johnson, might offer to push through a package of military aid for Ukraine if, among other conditions, Biden scraps the restrictions.

Insight from our panelists

Goldman Sachs analysts said:

“The structural deficit in European natural gas has yet to be fully resolved with increased LNG supply not yet fully making up for lost Russian imports. Thus, European gas prices remain vulnerable to supply interruptions or increases in demand. This is especially the case during winter, when weather-dependent heating comprises the bulk of demand and bouts of cold weather can lead to rapidly falling stocks and higher prices.”

Desjardins analysts commented:

“The Biden administration’s announcement that it would pause the approval process for building new liquefied natural gas (LNG) export terminals […] has rekindled fears of an oversupplied market. In addition, warm weather in North America has slashed heating demand. Over the past 12 months [to March], the average temperature in the United States has been 1.3°C higher than the historical average. In combination with record US output, these factors sent Henry Hub prices down.”

Download our free special report on the natural gas prices outlook