From 4 August, China launched a series of military drills close to Taiwan, in response to Nancy Pelosi—the Speaker of the U.S. Congress—visiting the country in July. In response, in mid-August the U.S. sent a fresh delegation to Taiwan and announced it would soon begin formal trade talks with the island.

For now, the global economic impact should be negligeable, barring a likely slight hit to Taiwan’s growth prospects due to weaker business sentiment and some disruption to trade. The bigger danger lies in the longer term, as U.S.-Taiwan ties are set to deepen over the next few years. By antagonizing China, this will likely lead to further military drills and economic retaliation from Beijing against Taiwan—and potentially against the U.S. too.

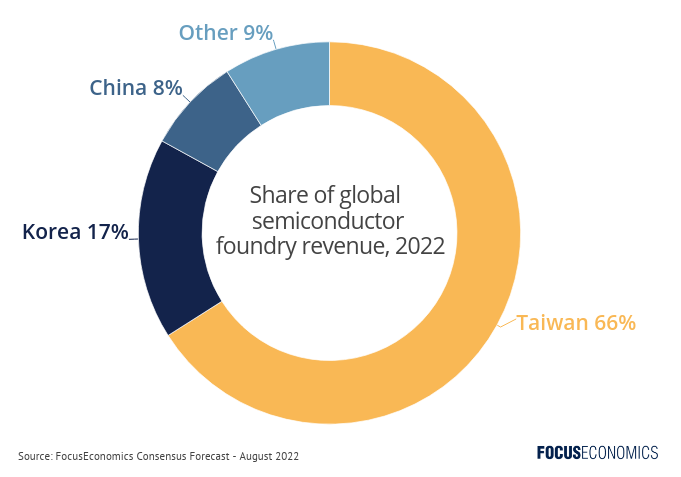

In such a scenario, some firms would re-rout investment from Taiwan to other parts of Asia to minimize geopolitical risk. Moreover, frequent Chinese military drills around Taiwan could delay global shipping and raise transport costs: Almost half of the global container fleet has passed through the Taiwan Strait so far this year according to Bloomberg data. In particular, any delays to shipments of semiconductors—an industry in which Taiwan is the world’s dominant player—would hit world production of a host of goods, from smartphones to SUVs. Plus, a further deterioration of U.S.-China relations due to Taiwan would hurt trade between the two superpowers and further accelerate the decoupling of supply chains, damaging global growth.

Of course, by far the worst outcome for the global economy would be a Chinese invasion of Taiwan. This would set the stage for a series of tit-for-tat sanctions between China and the West, likely pummel semiconductor supply and risk morphing into a global conflict of untold economic proportions.

Insights from Our Analyst Network

Ma Tieying, economist at DBS Bank, said:

“The world’s major economies will likely continue to push for semiconductor investment in their home markets, to prevent the risk of chip supply shortage from Taiwan. The US successfully lobbied TSMC to build a 5nm chip factory in Arizona in 2020. Japan also convinced TSMC to construct a fabrication plant in Kumamoto last year. More recently, the US Congress passed the CHIPS and Science Act in July, providing USD52.7bn funds for the American semiconductor R&D, manufacturing and workforce development. […] A global race for semiconductor investment could induce additional chip production costs and aggravate the risk of overcapacity in the longer term.”

Analysts at the EIU commented:

“A future flash point will be negotiations around formal US Taiwan trade talks. Although these developments are only rumours at this point, the initiation of formal trade negotiations (which may go beyond the scope of US Taiwan trade and investment talks in June) would probably prompt a strong Chinese response, in ways that could exacerbate the risks and uncertainty currently facing cross Strait supply chains.”