The European Central Bank increased interest rates for the first time since 2011 in July. The Bank indicated further hikes ahead as it hopes to reach its 2.0% inflation target in the medium term; Euro area inflation hit a series high of 8.9% in July.

But the ECB’s hawkish turn poses a problem: It threatens to further widen bond spreads between the highly-indebted southern countries and northern countries, which are considered far less volatile environments for investment. In response, the ECB announced the creation of the Transmission Protection Instrument (TPI). The TPI allows the ECB to make potentially unlimited purchases of public debt in order to narrow bond spreads between core and peripheral Euro area countries.

However, the ECB has said it would prefer not to use the TPI. Buying heavily-indebted countries’ debt could encourage moral hazard: governments may take on more debt if they knew servicing costs would be artificially deflated by the TPI. Instead, the Pandemic Emergency Purchase Program (PEPP) remains the “first line of defence,” ECB President Christine Lagarde explained. The ECB stopped net purchases of government bonds under the PEPP in March. Now, as the debt from those purchases matures, the ECB is reinvesting it strategically in order to cap borrowing costs in peripheral economies. In June and July, ECB data indicates that the Bank sold nearly 20 billion euros of French, Dutch and German bonds, and bought over 17 billion euros of debt in Italy, Spain, Portugal and Greece.

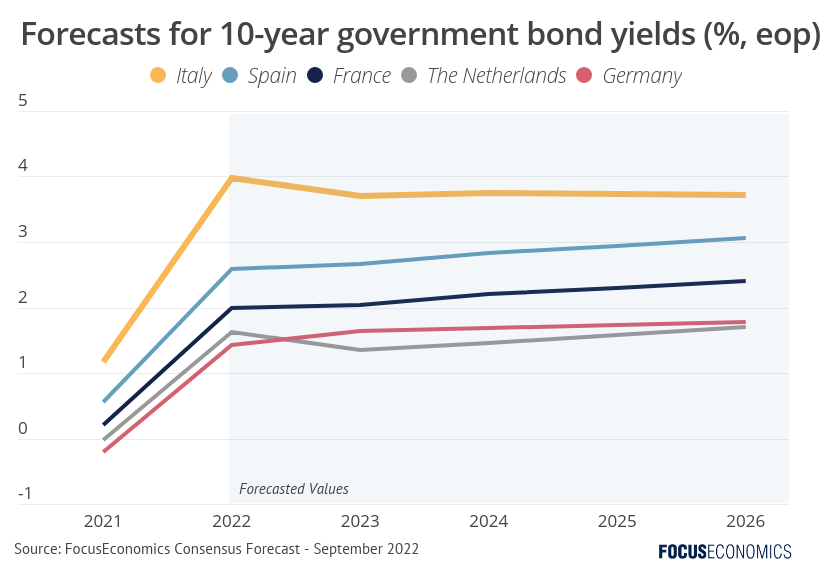

Therefore, the TPI is only likely to be put to use in the case of speculative selling of peripheral countries’ bonds. Italy, where public debt amounts to 150% of GDP, would be the most likely recipient of intervention amid recent political chaos. Spreads between German and Italian 10-year bond yields sat at around 2.3 percentage points at the end of August, having peaked at above 2.4 percentage points in late July. There is significant risk associated with the September snap elections—the likely victorious rightwing coalition has pledged tax cuts, which could enlarge Italy’s debt pile further and cause bond yields to spike.

In any case, the TPI may not need to be used in order to be useful. The mere announcement of the TPI went some way towards limiting the ascent of Italian bond yields. Similarly, the Outright Monetary Transactions (OMT) scheme—also designed to limit spreads—was announced in 2012 during the European sovereign debt crisis but has never been used. The creation of the OMT itself decreased risk perceptions, supporting investment and lowering government bond yields in Spain and Italy.

That said, while new tools such as the TPI will stop bond spreads from becoming too extreme, our analysts still expect a notable premium on peripheral country bonds relative to German ones over our forecast horizon to 2026.

Insights from our analyst network:

George Buckley, chief UK and Euro area economist at Nomura, commented on the imprecise nature of the TPI’s guidance:

“Details behind the scheme were limited. However, that didn’t appear because it wasn’t finalised but rather what seemed like an intentional decision to give the Governing Council significant latitude to decide on whether and by how much to intervene – and presumably to avoid the markets constantly testing specific spread levels at which the ECB might intervene.”

Analysts at Goldman Sachs highlighted how that uncertainty may not prevent investors from manipulating the bonds market:

“We view the TPI as a potentially powerful tool that could ultimately be effective in anchoring sovereign credit in Europe. However, the lack of clarity on the conditions under which TPI will be activated suggests that market participants could test the ECB’s resolve, especially in the context of higher political uncertainty in Italy.”