In this insight piece, we examine the outlook for emerging markets for next year. From the anticipated robust expansion in South Asia to the nuanced challenges faced by regions such as Latin America, we aim to provide a sophisticated perspective for investors, policymakers, and those navigating the complexities of global markets.

Join us in unraveling the dynamics, risks, and opportunities that will shape the future of emerging market economies in the unfolding year.

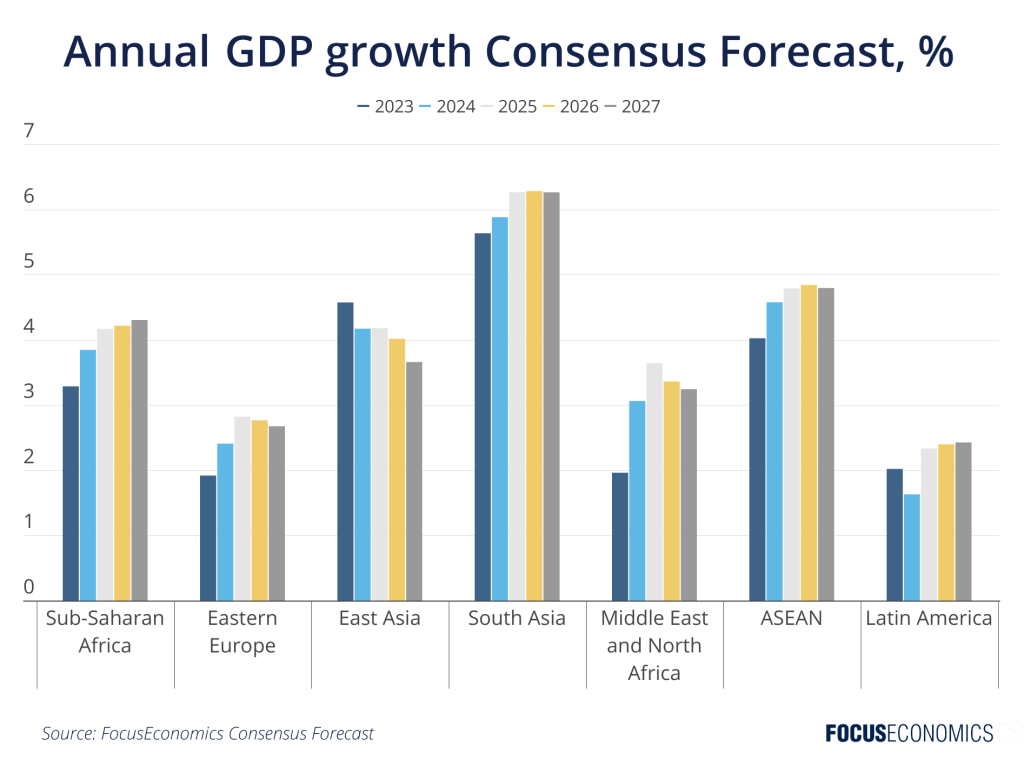

Global Market Forecasts: South Asia to Lead the Pack in 2024

Our panelists expect South Asia to be the fastest-growing world region both in 2024 and over our forecast horizon to 2027, thanks to stellar growth in India and Bangladesh. In particular, India will likely have continued success at attracting FDI from firms looking to invest in the country’s manufacturing sector, thanks to the government’s financial incentives, business-friendly reforms and firms’ desire to shift production away from China.

Asean, SSA and East Asia to grow between 3 and 5% in 2024:

ASEAN will benefit from an expanding consumer market, relatively stable politics, strong demographics and burgeoning manufacturing activity. While growth in Sub-Saharan Africa (SSA) will be close behind, after factoring in a population expanding at over 2% per annum, per capita growth in SSA will be far less impressive. East Asia will steadily lose steam over the next few years as China’s economy matures and ages.

1–3% growth forecast for remaining emerging market regions:

In 2024, the Middle East and North Africa region will have continued success at diversifying economic activity away from oil amid concerted government efforts in countries such as Saudi Arabia and the UAE, though socio-political instability and an ongoing reliance on hydrocarbons will likely cap growth at around 3%. The worst-performing emerging markets will be Eastern Europe—which has less potential for catch-up growth given already high GDP per capita—and Latin America, which lacks strong growth drivers outside the primary sector.

Key factors to watch:

Many emerging markets will hold elections next year, including India, Indonesia, Pakistan, Russia, South Africa and Ukraine, which could have an important bearing on the policy environment. Interest rates are another major risk factor: While our latest Consensus is for G7 policy rates to fall by end-2024, higher-than-expected interest rates in the West would translate into tighter financial conditions in emerging markets, weighing on growth. Further African coups, elevated debt burdens, conflict in the Middle East, divestment from China and nearshoring trends in Latin America and Eastern Europe are other factors to watch.

Insights From our Analysts

On nearshoring trends in ASEAN, DBS analysts said:

“Recent investment flow data suggest that North Asian entities continue to diversify supply chains towards ASEAN. […] The outbreak of the Covid pandemic and the increase in geopolitical risks have boosted demand for nearshoring or regionalisation of the supply chains. ASEAN should be a favourite destination for North Asian entities, thanks to their large domestic markets, affordable production costs, geopolitical neutrality, and deepening integration into the global value chain.”

On Latin American politics, EIU analysts said:

““Whatever their political affiliations, leaders across the region will not find governing easy. A collapse in electoral support for the moderate centre has enabled populist movements (on both the far left and the far right) to advance. However, the sluggish policymaking process will frustrate public demands for rapid and substantial results. In this context, honeymoon periods will be short and disillusionment will set in quickly, raising the risk of widespread destabilising protests akin to those that rocked the region in 2019.”

Our latest analysis

- Japan just announced a fiscal stimulus worth 3% of GDP. Will the package be enough to shift Japan’s economic growth into a higher gear?

- Chile’s economy bounced back in Q3. Yet as our analysis piece shows, the outlook ahead is troubled.

In our latest special report, we delve into the outlook for emerging market economies in the coming years, against a backdrop of increased global geopolitical tensions, nearshoring and climate change.