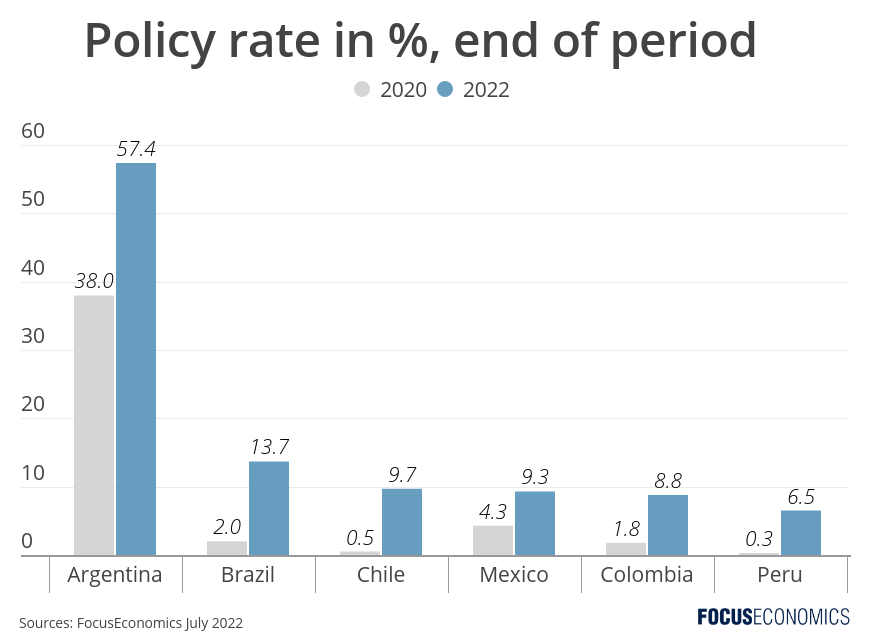

Central banks in Latin America can certainly not be accused of remaining passive in the face of rising price pressures. They were the first to begin hiking interest rates towards the end of last year, and since then have engaged in by far the most aggressive monetary tightening of any world region. Our analysts forecast the average policy rate in Latin America to rise from 5.7% at end-2020 to 15.5% at end-2022, a nearly 10 percentage point increase. In contrast, over the same period, interest rates in G7 economies are projected to go from 0.1% to 2.2%, while those in Asia ex-Japan are expected to tick up from 1.9% to 2.5%. Yet, despite the authorities’ best efforts, Latin American inflation has risen virtually uninterruptedly since early 2021, and clocked over 15% in June (excluding Venezuela), a multi-year high.

So why has monetary tightening seemingly had such a limited impact on prices? A number of factors are likely at play. The first is that the large informal economy—which accounts for over half of all jobs in the region—reduces the effectiveness of monetary policy; households engaging in cash-in-hand work with no access to the formal banking system are likely less sensitive to changes in interest rates. Moreover, the region’s long history of bouts of extremely high inflation means the credibility of central banks is shakier than in other parts of the world, which could be de-anchoring inflation expectations. Latin American currencies have also suffered sharp selloffs over the last two years due to global uncertainty and the normalization of the Fed’s monetary policy, leading to higher import prices and partially negating tighter monetary policy. Sociopolitical instability in many Latam countries has also contributed to currency weakness.

Wage indexation and severe drought in the region affecting food prices and hydroelectric generation have also boosted inflation, on top of the universal increases in food and fuel prices as a result of the war in Ukraine. Plus, underlying price pressures have likely risen more in Latin America than many other parts of the world. Relative to Asia, for instance, Latin America in general suffered a far steeper pandemic-induced downturn, but then lifted Covid-19 restrictions more quickly, resulting in a stronger recovery in domestic demand.

The upshot is that inflation in Latin America is expected to end this year well into the double digits, dampening purchasing power. To bring inflation down sharply would require more aggressive rate hikes or for governments to tighter their fiscal stances, although both would risk an economic downturn and could spur social unrest.

Insights from Our Analyst Network

On inflation and interest rates in Chile, analysts at Goldman Sachs said:

“Headline and core inflation prints remain high and the outlook for inflation remains challenging. Furthermore, the sharp depreciation of the CLP in the past month is likely to further increase inflationary pressures. […] Consequently, we believe that the MPC will raise the policy rate further in the next couple of meetings to a terminal rate of at least 9.75%. We continue to see risks as skewed to the upside with a double-digit terminal rate a growing possibility, and we expect monetary policy to remain tight over the relevant policy horizon given our expectation for stickier inflation as cost pressures (e.g., higher labor costs given accelerating nominal wages) are passed to final consumer prices.”

On regional interest rates, analysts at the EIU said:

“We continue to believe that interest rates in the region will, by and large, reach their terminal levels by the second half of the year. Although most Latin American central banks do not have explicit mandates to maximise employment or growth, they will nonetheless be wary of tightening policy to the point where it becomes recession-inducing. There are, however, risks to this benign view, given the potential for aggressive monetary tightening in the US to generate emerging-market asset sell-offs.”

Global inflation this year will be spurred by higher food and fuel prices, currency depreciation in many countries, and the lifting of Covid-19 restrictions.

See our latest inflation forecasts and analysis.