According to data compiled by the Minerals Council of Australia, iron ore production increased from around 170 million tonnes annually in 2000, to 660 million tonnes in 2014. This coincides with what is often referred to as the “global commodities super cycle”, a period in which commodities prices rose to dizzying heights and remained elevated over the 2006–2014 period. In 2011, natural resources helped to push Australia’s terms of trade to peak at the highest level in 140 years; in 2013–2014, iron ore was the country’s top export, making up over a quarter of Australia’s total goods exports, this was reflected by the Reserve Bank of Australia’s increase in the weight of iron ore in its commodity index substantially in 2013.

|

FREE Sample – Commodities Report Download a sample of our new Consensus Forecast Commodities report 33 commodities in the energy, metals & agricultural sectors Price forecasts, historical data, & written analysis |

Owing to a number of factors, the commodities turned from boom to busts in late 2014, and prices plummeted, leaving mining companies scrambling to cover losses. The new roads, factories, homes and even cities that drove Chinese demand for commodities were not being built at the same pace as they were before, and excess capacity in the Chinese economy began to grow. Compounding the decrease in demand, was an increase in supply. Mining companies, including those with operations in Western Australia, had increased production capacity in response to the boom in commodity prices, leaving the world awash with resources as demand began to ease.

The Commodity Currency

Despite iron ore prices collapsing over the course of 2014–2015, the commodity still makes up the bulk of Australian exports. It is little wonder then that the Australian dollar is so closely linked in to iron ore prices. Aussie ore must be purchased with Aussie dollars at the end of the day, and as demand falls for the base metal, so too does demand for the AUD. However, the relationship between the pair has not always been so obvious.

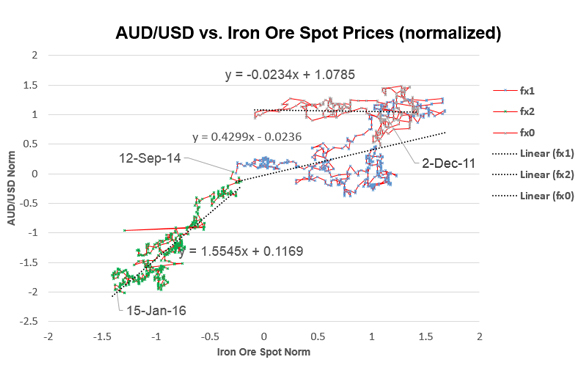

Figure 1: Iron ore spot prices and AUD/USD closing rate (normalized)

In Figure 1, one can see the relationship between the Australian dollar and the spot price of iron ore 62% Fe import including freight and insurance at the Chinese port of Tianjin, traded in USD per metric ton (as per the FocusEconomics Iron Ore Commodity Forecast.) The pair have a strong positive correlation, meaning that if the spot prices increase, it is likely that the currency strengthens (0.88 correlation coefficient). The currency is expressed in USD terms, as is the spot price.

With a quick glance at Figure 2 below, one can see that the relationship between the two indicators is not constant. Over 2012, the value of the currency and the spot price of iron seem to share a weaker link than in the post-September 2014 period.

Figure 2: Iron ore spot prices and AUD/USD closing rate (normalized)

The relationship captured via a scatterplot in Figure 2 above, gives a better idea of the spot price/currency dynamic over time.

The more recent the time frame, the closer to 1.00 the correlation is between spot prices and the AUD/USD FX rate (a coefficient of 1.00 indicates a perfect one to one relationship) . The trend lines in the figure 3 also indicate that the relationship is becoming more extreme in the more recent section. From 1 December 2011 to 31 December 2012, the slope of the trend line was close to zero, and even negative, suggesting an insignificant relationship. From 12 September 2014 to 16 January 2016, the slope jumped to 1.39, indicating that on average a 1 unit decrease in the spot prices, corresponds to a 1.39 unit decrease in the AUD/USD FX rate. A substantially more distinctive relationship than compared to the December 2011 to December 2012 time period.

What the Future Holds

It is natural to assume that a commodity currency, such as the AUD, would react strongly to prices for main exports, however, as demonstrated by the above charts, the association has not been constant and appears to be increasing as the spot prices for iron follow a steeper downward trend, with the relationship becoming more apparent the later the time period.

There may be a number of reasons behind this. Iron ore’s significance in Australia’s export profile has continued to increase up until 2015, and it may have crossed a threshold around September 2014, at which point more investors started tracking iron ore prices as a marker of the health of the Australian economy. This just happened to coincide with a period of falling iron prices. There may also be evidence of some asymmetry in the minds of investors, where decreasing iron ore prices may have more of an impact on the AUD than increasing prices. This is not uncommon and has been seen in other financial markets as well.

The question is therefore not why there is such a strong link between the AUD and iron ore prices, but why the link is not persistent and why is the relationship expected to weaken going forward? There may be many answers to this question, ranging from the Australia government’s attempt to lessen reliance on the commodity sector to steady declines in stock prices for some of Australia’s biggest iron ore companies (Rio Tinto and BHP Billiton for example). FocusEconomics Consensus Forecasts indicate a decoupling of the currency-commodity pair going forward. Iron ore spot prices are forecast to see a gradual recovery, while the AUD is set to remain subdued as the economy undergoes a restructuring, and traditional exports wain in importance.

Conclusion

A more complete answer may arise when one looks at the forest for the trees. The waning of the commodities super cycle, which is driven by both increased supply and decreased demand, is reducing the importance of commodities in the export profiles of countries like Australia. The total value of Australian iron ore exports fell 27.1% between 2013/2014 and 2014/2015, and it is expected to decrease again this year. This will lessen the importance of iron ore prices on the health of the Australian economy, and hence loosen the commodity’s grip on the currency.

Murmurs in China over GDP targeting and fiscal spending to spur growth in early March may have bumped up the value or iron ore in the eyes of some prospectors, but it is likely that the commodity will not reach the dizzying heights characterized in the past year. The townships of Western Australia have already been decimated by job losses and disinvestment as mining giants shed jobs and revenue. Unfortunately for these towns, and for a large portion of the Australian economy, the worst is yet to be felt. It took years of investment in mining infrastructure before Australia could produce enough iron to meet China’s insatiable demand during the past 10 years. It will take several more before Australia’s economy can fully adjust to the easing of the commodity supercycle.

Written by: Robert Hill, Economist

|

FREE Sample – Commodities Report Get a sample of our new Consensus Forecast Commodities report 33 commodities in the energy, metals & agricultural sectors. Price forecasts, historical data, & written analysis

|

Other Pages of Interest:

Australia Economic Outlook

AUD/USD Exchange Rate

Iron Ore Price Outlook

Base Metals Price Outlook