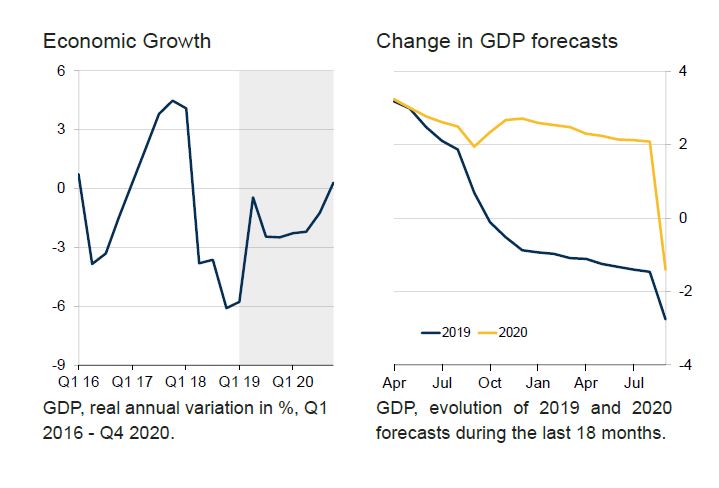

Argentina’s economic outlook has deteriorated notably since August’s LatinFocus edition. The primary elections on 11 August revealed that President Mauricio Macri is trailing in a very distant second place in the run-up to the October elections, shocking market analysts and sparking a huge and destabilizing capital flight in turn. The drastic change in political landscape and unfolding market turmoil has significantly affected the country’s outlook, particularly for next year. Now, GDP is seen contracting for the third year in a row in 2020, as the exchange rate’s drastic depreciation stokes inflation and forces even tighter monetary policy, suppressing consumption. Moreover, lower sentiment and the uncertain political situation, especially regarding the government’s finances and ability to honor its debts, will damage investment.

In this accompanying feature, Argentina Economist Massimo Bassetti explains where the crisis is now and what to expect ahead, while several of our panelists provide insight into their forecasts, the current situation and what they see ahead.

Government resorts to capital controls in bid to combat currency crisis

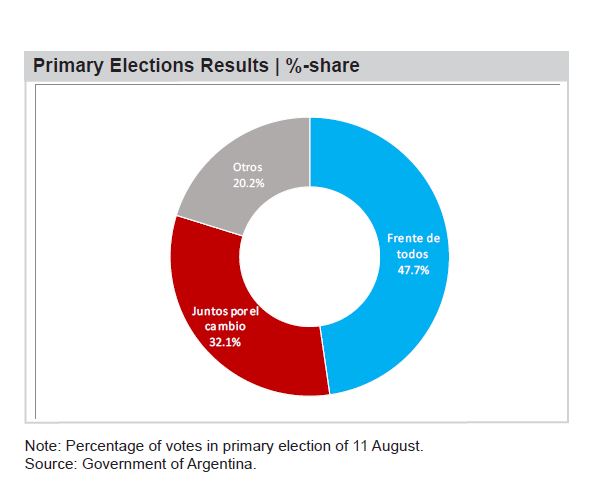

The government unveiled a series of measures in August and September as part of efforts to stem the financial market turmoil unleashed by August’s primary elections. The Macri administration authorized capital controls, postponed payments on short-term debt and announced it would seek a “voluntary reprofiling” of longer-term debt maturities, most of which are held by foreign investors, including USD 44 billion by the IMF, in an attempt to steady the spiraling peso and avoid debt default. This followed the unexpectedly large victory of opposition candidate Alberto Fernández’s Everyone’s Front coalition (Frente de Todos)—and the consequent defeat of Macri’s Together for the change coalition (Juntos por el Cambio)—at 11 August’s primary elections, which spelled Fernández’s likely victory on 27 October and thus dramatically increased the likelihood of interventionist policies and a default on sovereign debt.

What next?

It is currently uncertain whether the measures implemented by the government will successfully steady the economy. While capital controls will help limit dollar outflows and reserve depletion in the short-term, they risk widening the gap between the official and black-market FX and will also likely hit business investment. Moreover, uncertainty is elevated over how the next administration will handle the country’s IMF deal and current financial crisis. Fernández has so far said that he would look to renegotiate the country’s debt, introduce a price and salary agreement to reduce inflation, achieve a stable primary surplus and move towards a floating exchange rate. However, although Alberto Fernández is largely considered to be a moderate Peronist, the specter of his running mate, populist former-President Cristina Fernández de Kirchner, looms large. Particularly, investors are on edge that a Fernández-Fernández victory would mean a return to runaway government spending, nationalizations, price controls and a politically-dominated Central Bank, which risks further battering investor confidence and derailing the Argentine economy.

LatinFocus Consensus Forecast

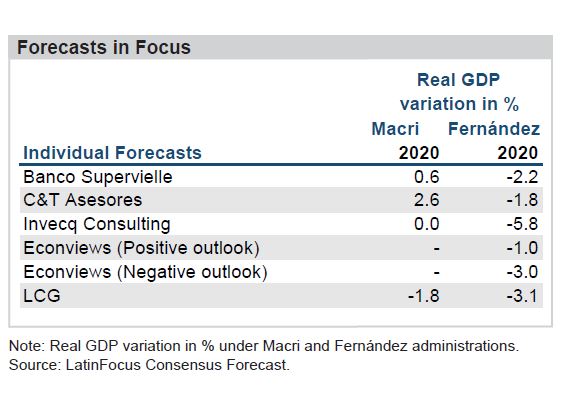

The changed political landscape prompted LatinFocus Consensus Forecast analysts to drastically revise their expectations this year and the next. The high probability of a Peronist victory at October’s elections has clearly clouded the outlook, re-awakening fears of a return to the harmful populist policies of the past. The economy is now seen contracting 2.8% in 2019, which is down 1.3 percentage points from last month’s estimate, and falling by 1.4% in 2020, which is down 3.5 percentage points from last month’s forecast.

What our panelists say

Below are a series of quotes from our panelists, explaining recent revisions to their projections:

Camilo E. Tiscornia, director at C&T Asesores:

“The unexpected outcome of the primary election has changed everything. Now, the most likely situation is that the opposition will win the general election. Our projections include a significant downside risk: if a smooth political transition is not achieved, the exchange rate will rise further, as will inflation, while GDP will fall more sharply. On this point, it is crucial that this does not unleash a massive outflow of deposits.

There is no doubt that the change of government would have a profound impact on economic policy, characterized by a shift towards further state intervention and the likely return to measures used by the opposition when it was last in government. Nevertheless, the underlying question is to what extent economic policy would change: the key factor will be the resolution of tension between the supposedly moderate Alberto Fernández and the more radical Cristina Fernández de Kirchner. Our projections assume some moderation. On this point, it should be noted that the fiscal situation will require a great deal of attention. In the short term, the IMF’s disbursement is a critical factor.”

Economists at LCG:

The episodes of volatility will negatively affect activity, which has already been at low levels. The recently introduced capital controls, however, could buffer help the currency. Despite the deflationary process that had begun in March, the jump in the exchange rate will further accelerate prices in an economy that is increasingly indexed. For this reason, we see an even more pronounced fall in purchasing power that will hit consumption and investment ahead. On the external front, we expect the current dynamic to continue, with a strong contraction of imports and a marginal uptick of exports owing to the worsening terms of trade.”

Miguel Kiguel and the research team at Econviews:

To complete the initiatives to ease the debt burden, the government will seek to renegotiate the payments to the IMF and will hire banks to start discussing with international law bondholders a friendly swap to extend maturities of debt coming due the next 10 years. After the Primaries, and due to increased political uncertainty, the roll-over ratio for debt slumped. This effect increased the pressure on international reserves at a time when the Central Bank was trying to stabilize the market with FX intervention. The situation was not sustainable and the government had to do something about.”

Pamela Ramos, economist at Oxford Economics:

The outlook is uncertain, but we think ‘haircuts’ will ultimately be unavoidable, either if creditors agree to the reprofiling and even more so if not. It is our view that Argentina is facing both liquidity and solvency problems in its public debt, and that just a rollover of maturities will not be enough to restore debt to sustainable levels.

Research team at Fitch Solutions:

“We at Fitch Solutions have significantly downwardly revised our near and medium-term growth forecasts for Argentina in light of an expected transfer of power following October’s general election. We now forecast real GDP growth of -2.6% in 2019, from -1.3%, and -2.7% in 2020, from 2.5% expansion previously. Uncertainty over policy direction and risks to the country’s fiscal and external accounts will lead to continuing falls in consumption, investment and exports over the coming quarters. The likely return of more populist economic policymaking will stifle investment over a multi-year timeframe, particularly if Argentina’s access to capital markets remains severely restricted.”