“A good and spacious land, a land flowing with milk and honey”; So reads the Bible in the Book of Exodus, in reference to the area roughly corresponding to modern-day Israel.

The nascent Jewish state which emerged following WW2 could not have been any further from this description. At the time, the economy was overwhelmed by a huge influx of refugees from around the world. There was an acute shortage of foreign currency. Infrastructure was in a dire state. The situation was so critical that food rationing was implemented in 1949.

Fast forward 70 years, however, and the country has been transformed. The economy has successfully absorbed successive waves of immigration; GDP per capita has risen from USD 8,700 in 1960 to around USD 35,000 today; and growth is strong by developed-country standards. Israel now boasts a large current account surplus with the rest of the world, and a flourishing technology industry. Our panelists are optimistic about medium-term prospects.

Karnit Flug, former governor of the Bank of Israel, was effusive in a 2018 speech; “Where we were once a country whose ultimate pride was in the export of oranges, and which suffered from a chronic balance of payments deficit […] we have become a country with a balance of payments surplus, a surplus of assets over liabilities, and inflation that we would like to be a little higher. […] at least for a moment, we can stop and look back with satisfaction”.

Challenges remain, however. Economic potential is being clipped by lackluster infrastructure, dense red tape and the low labor participation of the Arab and Haredi Jewish communities, while the fiscal deficit has ballooned over the last year. Moreover, tackling these structural issues is currently virtually impossible, given political paralysis—there is still no new government following inconclusive September elections.

- Discovering its economic chutzpah

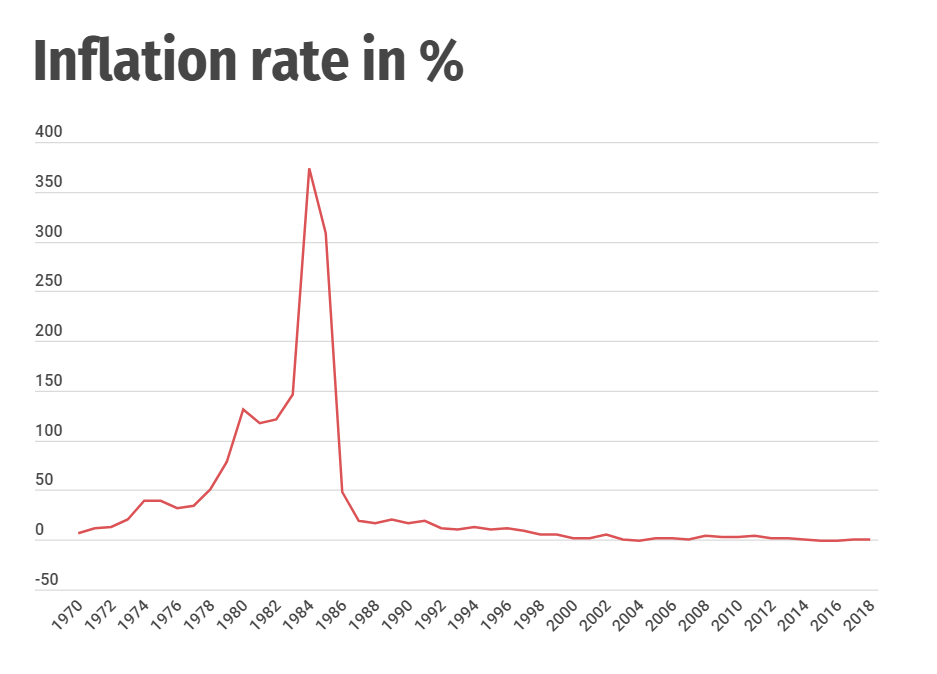

Economic expansion in the decades following the country’s foundation was led by the public sector, with strong protectionist measures and government financial support to strategic industries. But this model had run its course by the mid-1970s. Growth was paltry, the fiscal deficit gaping, and the economy was in the grip of hyperinflation—which peaked at 373% in 1984.

Source: World Bank

Source: World Bank

Economic policy took a radical change of direction from the 1980s onwards, with an extensive privatization program, wage restraint and steps to rein in the fiscal deficit and public debt.

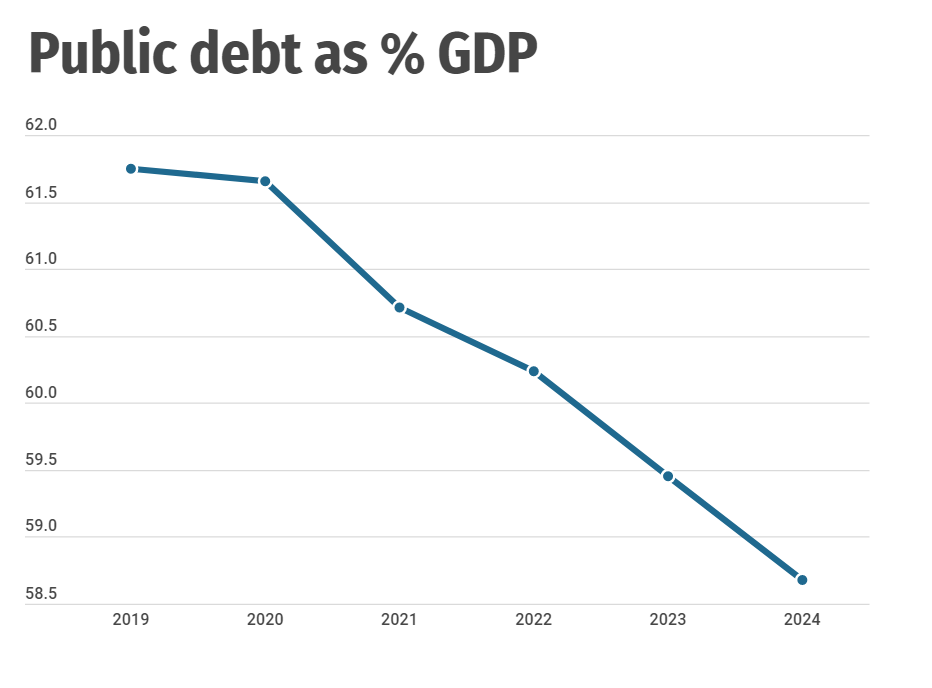

These measures can certainly claim some successes. Growth has averaged 4.2% since 1985, while public debt has fallen from over 90% early in this century to a little over 60% in 2018.

The country has also nurtured a world-leading tech scene. Tel Aviv, Israel’s innovation capital, boasts the largest number of start-ups per capita in the world. Hundreds of multinationals—including Intel and Google—have R&D facilities in the country. And dozens of Israeli firms are listed on the NASDAQ, the U.S. technology-focused stock exchange.

The reasons behind this success are manifold. Investment has likely been key; Israel currently spends more as a percent of GDP on research and development than any other country, according to World Bank data.

Moreover, the 1990s saw an influx of hundreds of thousands of immigrants from the former USSR, many of whom were engineers and scientists. This seeded the economy with the vital know-how to kickstart the technology industry.

Access to finance has also been instrumental, not only through venture capital firms but also the government. The Israeli Innovation Authority provides grants, seed funding and support services to promising start-ups.

The public sector has also had a strong bearing on the tech industry via the military. Surrounded by potential enemies and honed by decades of conflict, the Israeli military has long been interested in technology which could give it an advantage in the field. The elite Unit 8200, for instance, selects the best and brightest young minds and conscripts them into intelligence gathering and cyber security. Many Unit 8200 graduates go on to form start-ups, often with a military bent; Israeli exports of cyber security products are worth USD 7 billion, and account for close to 10% of the global market.

- Looking ahead

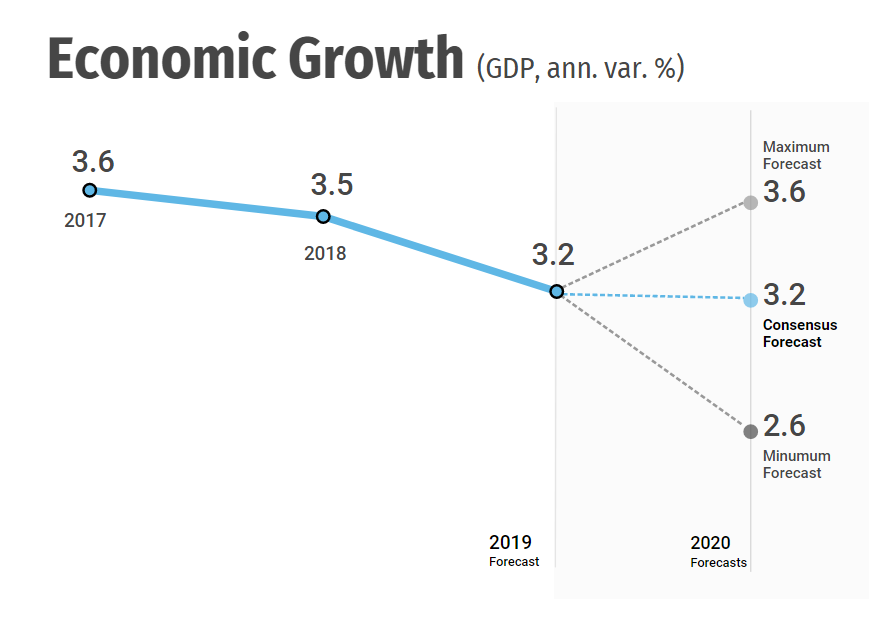

FocusEconomics panelists are broadly optimistic on the economic outlook, even though momentum is seen somewhat below the rate observed over the last decade. From 2019–2024, panelists see growth averaging 3.3%, supported by rapid population growth and the continued success of the high-tech sector. Moreover, the imminent start of operations at the huge Leviathan gas field will turn Israel into a regional energy power, boost gas exports and line state coffers.

Source: FocusEconomics Consensus Forecast, MENA December 2019

Source: FocusEconomics Consensus Forecast, MENA December 2019

Gil M. Bufman, chief economist at Bank Leumi, highlights other advantages of Leviathan: “Natural gas activities are important as they will drive investments in machinery and equipment, they will help to improve the competitiveness of some sectors of the economy”.

Our panel also sees other economic metrics evolving healthily: The current account is seen remaining in surplus, the currently-large fiscal deficit is forecast to gradually shrink, while public debt is expected to continue declining.

Source: FocusEconomics Consensus Forecast, MENA December 2019

Source: FocusEconomics Consensus Forecast, MENA December 2019

However, the economy still suffers from important weaknesses. While rosy demographics may buoy short-term growth, they also present a longer-term problem. A significant part of population growth is being driven by Haredi Jews, whose labor participation rate is far below average. The Haredi percentage of the population is expected to virtually double by 2040, which could put severe stress on government finances without a corresponding increase in the participation rate.

Simultaneously, Israel is witnessing a brain drain among the high skilled. According to the Shoresh Institute: “the ratio of academic emigrants to academic returnees has been rising in recent years. In 2014, 2.6 persons with an academic degree left Israel for each one who returned. By 2017, this ratio had risen to 4.5 emigrants per returnee.”

Moreover, education outcomes lag many developed countries, particularly in Haredi and Arab communities, fueling sharp inequality and sluggish productivity growth. Shoddy infrastructure—Israel has the developed world’s most congested roads—and restrictive bureaucracy are further impediments to the economy.

Even the success of the seemingly unstoppable tech sector should not be taken for granted, according to Padmasai Varanasi, an economist at Oxford Economics: “tensions have been growing along Israel’s borders with Syria, Lebanon, Iraq and Palestine due to an escalation of the conflict between Israel, Iran and Hezbollah. These pose a major downside risk if the ongoing cycle of military air strikes by Israel and threat of counter strikes by Iran continue. The opportunity cost of isolation is significant in terms of trade and labour flows and could weigh on Israel’s ability to act as a regional hub for high-tech investment.”

Faced with these challenges, the government is currently missing in action due to protracted parliamentary gridlock, with neither the right-wing nor left-wing blocs able to command a majority. The third elections in 12 months are a rising possibility.

As such, it is clear that Israel is still a far cry from the economic promised land. But conditions have still improved significantly over the past decades, and the challenge for the next government—assuming it is able to break out of the current political torpor—will be to keep the momentum going.

As Gil M. Bufman remarks: “The political stalemate has led to a suspension of longer term structural economic policy initiatives and implementation. Hopefully, when the government is formed, it will prioritize structural changes that are much needed by the private sector.”