Nigeria Economic Outlook

Africa’s largest economy:

Nigeria is the largest economy in Africa, with a GDP exceeding $500 billion, driven by its vast oil and gas reserves. However, despite its size, the country struggles with deep structural economic issues, including weak infrastructure, high inflation, and low foreign investment. Growth has been sluggish in recent years, averaging around 2-3%, barely keeping up with population expansion, which is among the fastest in the world.

Oil dependency and diversification struggles:Nigeria’s economy remains highly dependent on oil, which accounts for over 90% of export earnings and a significant portion of government revenue. However, fluctuating oil prices and production disruptions—often due to militant attacks in the Niger Delta—have led to volatile economic performance. The government has made attempts to diversify the economy, particularly in agriculture, manufacturing, and technology, but these sectors still struggle with inadequate investment and poor infrastructure.

High inflation and currency challenges:Nigeria’s recent economic indicators have made for dour reading. The country faces persistently high inflation, which has remained in the double digits for years, eroding consumer purchasing power. The country also grapples with currency instability, exacerbated by a dollar shortage and a complex exchange rate system. Recent moves to unify the exchange rate have led to significant depreciation of the naira, adding to inflationary pressures.

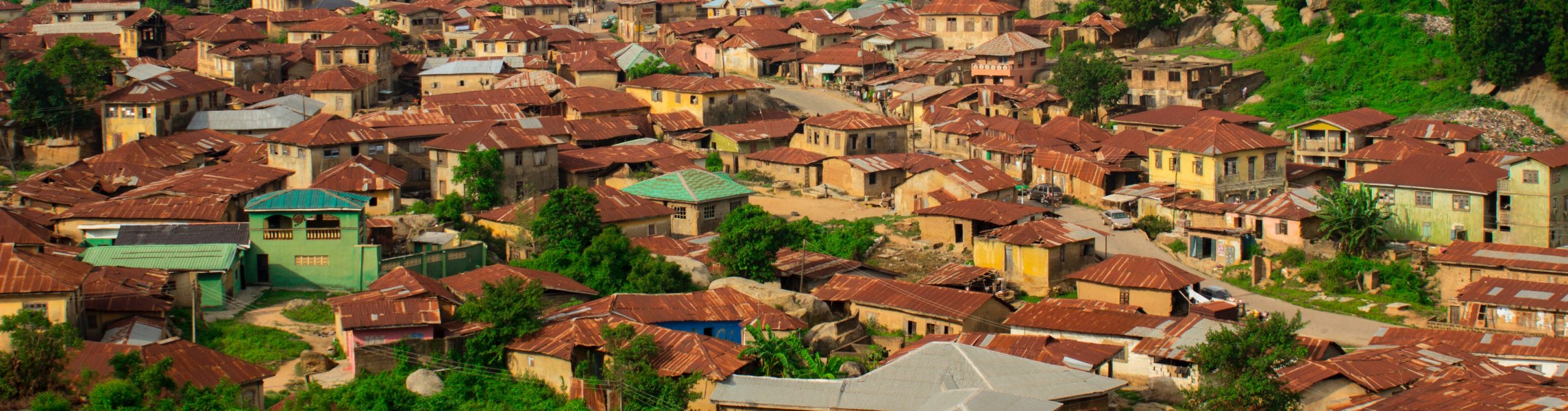

Challenges and risks:Nigeria’s business environment is hampered by security concerns, corruption, and weak governance. The ongoing insurgency in the northeast, banditry in the northwest, and secessionist tensions in the southeast create an uncertain investment climate. Additionally, power shortages and inadequate transport infrastructure further hinder industrial growth and productivity.

Nigeria’s economic outlook:In the medium term, Nigeria’s growth predictions remain modest, driven by the non-oil sector, including fintech and digital services. However, sustaining growth will require bold economic reforms, including fixing the foreign exchange system, improving electricity supply, and creating a more business-friendly regulatory environment. Without these changes, Nigeria risks falling further behind in Africa’s economic race.

Nigeria's Macroeconomic Analysis:

Nominal GDP of USD 188 billion in 2024.

Nominal GDP of USD 363 billion in 2023.

Nominal GDP of USD 188 billion in 2024.

GDP per capita of USD 824 compared to the global average of USD 10,589.

GDP per capita of USD 1,636 compared to the global average of USD 10,589.

GDP per capita of USD 824 compared to the global average of USD 10,589.

Average real GDP growth of 2.1% over the last decade.

Average real GDP growth of 2.3% over the last decade.

Average real GDP growth of 2.1% over the last decade.

Sector Analysis

In 2022, services accounted for 42.8% of overall GDP, manufacturing 15.4%, other industrial activity 19.1%, and agriculture 22.7%. Looking at GDP by expenditure, private consumption accounted for 62.2% of GDP in 2019, government consumption 5.1%, fixed investment 33.8%, and net exports -1.1%.International trade

In 2023, manufactured products made up 2.8% of total merchandise exports, mineral fuels 91.6%, food 3.8%, ores and metals 1.2% and agricultural raw materials 0.4%, with other categories accounting for 0.2% of the total. In the same period, manufactured products made up 52.0% of total merchandise imports, mineral fuels 33.4%, food 10.7%, ores and metals 0.9% and agricultural raw materials 0.4%, with other goods accounting for 2.6% of the total. Total exports were worth USD 53 billion in 2024, while total imports were USD 39.80 billion.Main Economic Indicators

Economic growthThe economy recorded average annual growth of 2.3% in the decade to 2023. To read more about GDP growth in Nigeria, go to our dedicated page.

Fiscal policy

Nigeria's fiscal deficit averaged 4.4% of GDP in the decade to 2023. Find out more on our dedicated page.

Unemployment

The unemployment rate averaged 4.5% in the decade to 2023. For more information on Nigeria's unemployment click here.

Inflation

Inflation averaged 16.3% in the decade to 2024. Go to our Nigeria inflation page for extra insight.

Monetary Policy

Nigeria's monetary policy rate ended 2024 at 27.50%, up from 13.00% a decade earlier. See our Nigeria monetary policy page for additional details.

Exchange Rate

From end-2014 to end-2024 the naira weakened by 89.1% vs the U.S. dollar. For more info on the naira, click here.

Economic situation in Nigeria

GDP grew 4.2% year on year in Q2, following a 3.1% increase in the previous quarter. Q2’s print marked the fastest growth rate in four years and exceeded market expectations. The oil sector drove the acceleration, surging 20.5% in the second quarter (Q1: +1.9% yoy) as crude oil production hit a five-year high, bolstered by higher demand from Dangote refinery—Africa’s largest—which is ramping up output of diesel and gasoline. Moreover, non-oil sector growth accelerated too, supported by growth in the agricultural and industrial sectors. Turning to Q3, economic growth is set to ease; export growth moderated vs Q2 in July, and oil production growth lost traction in July–August. A three-day strike by oil workers knocked nationwide crude and marketed natural gas output by roughly 16% and 30%, respectively, adding to the hit from August’s closure of the Dangote gasoline unit due to a leakage.Nigeria Economic Forecasts

Projections out to 2035.47 indicators covered including both annual and quarterly frequencies.

Consensus Forecasts based on a panel of 24 expert analysts.

Want to get insight on the economic outlook for Nigeria in the coming years? FocusEconomics collects projections out to 2035 on 47 economic indicators for Nigeria from a panel of 24 analysts at the leading national, regional and global forecast institutions. These projections are then validated by our in-house team of economists and data analysts, and averaged to provide one Consensus Forecast you can rely on for each indicator. This means you avoid the risk of relying on out of date, biased or outlier forecasts. Our Consensus Forecasts can be visualized in whichever way best suits your needs, including via interactive online dashboards , direct data delivery and executive-style reports which combine analysts' projections with timely written analysis from our in-house team of economists on the latest developments in the Nigeria economy. To download a sample report on the Nigeria's economy, click here. To get in touch with our team for more information, fill in the form at the bottom of this page.