The misery index measures economic conditions by summing the unemployment rate and the inflation rate; the higher the summed reading, the more miserable the economy in question.

The concept was created by U.S. economist Arthur Okun in the 1970s. This was a decade in which surging oil prices led much of the world to suffer from both high inflation and unemployment, a phenomenon known as stagflation. The parallels with today are clear: Surging commodity prices are hitting purchasing power and forcing central banks into aggressive monetary tightening, which could hit labor markets over the next year and send many countries into a stagflationary scenario.

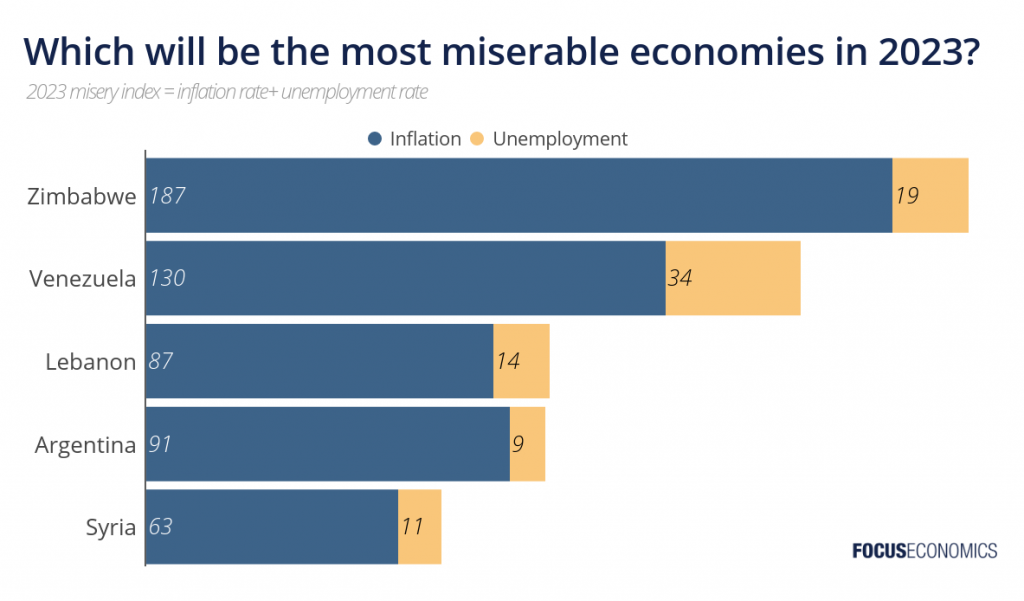

The misery index thus remains more relevant than ever. In this insight piece, we look at which are expected to be the world’s most miserable economies next year, using the Consensus Forecasts of our panel of expert analysts. For Zimbabwe and Syria, unemployment rate forecasts are unavailable, so the latest historical data point was used.

Click on the image to view a larger version

The misery index measures economic conditions by summing the unemployment rate and the inflation rate; the higher the summed reading, the more miserable the economy in question.

The concept was created by U.S. economist Arthur Okun in the 1970s. This was a decade in which surging oil prices led much of the world to suffer from both high inflation and unemployment, a phenomenon known as stagflation. The parallels with today are clear: Surging commodity prices are hitting purchasing power and forcing central banks into aggressive monetary tightening, which could hit labor markets over the next year and send many countries into a stagflationary scenario.

The misery index thus remains more relevant than ever. In this insight piece, we look at which are expected to be the world’s most miserable economies next year, using the Consensus Forecasts of our panel of expert analysts. For Zimbabwe and Syria, unemployment rate forecasts are unavailable, so the latest historical data point was used.

- Zimbabwe

2023 misery index: 187% (inflation rate) + 19% (unemployment rate) = 206

Zimbabwe is expected to be the world’s most miserable economy next year. The inflation rate is set to be the highest of any country, driven by rapid money supply growth and a collapse in the local currency, which depreciated from around ZWD 100 per USD at the outset of 2022 to over 600 in early November. The unemployment rate was estimated by the statistical office to stand at 19.3% in Q1 2022. High inflation and unemployment, together with a weak business environment, political instability, poor relations with the West and sky-high interest rates will continue to hold the economy back.

“Further efforts are needed to durably anchor macroeconomic stability and accelerate structural reforms. In line with recommendations from the 2022 Article IV consultation, the near-term macroeconomic imperative is to curb inflationary pressures by further tightening monetary policy, as needed, and allowing greater exchange rate flexibility through a more transparent and market-driven price discovery process, tackling FX market distortions, and eliminating exchange restrictions.” – International Monetary Fund

- Venezuela

2023 misery index: 130% (inflation rate) + 34% (unemployment rate) = 164

As has been the case for many years, Venezuela will continue to experience extremely high inflation in 2023, fueled by a projected collapse in the local currency, shortages and sustained money printing—money supply is seen rising by triple figures next year. Continued tough economic conditions will keep the unemployment rate at one of the world’s highest levels. The evolution of U.S. sanctions is a key risk to both indicators. Were the U.S. to loosen sanctions, this would support the currency, government finances, and economic activity more broadly, reducing inflation and unemployment. That said, broad sanctions relief is only likely if the Venezuelan government commits to holding free elections.

“In the short term, efforts to bring about disinflation will be undermined by elevated global commodity prices. In the medium to long term, persistent domestic supply shortages (stemming from Venezuela’s limited productive capacity) will be a hindrance, as will monetary policy challenges. More specifically, the BCV’s interventionist approach to currency management has produced renewed real bolívar overvaluation, pushing living costs up for the large swathe of Venezuelans who transact in US dollars but face prices in bolívares.” – Economist Intelligence Unit

- Lebanon

2023 misery index: 87% (inflation rate) + 14% (unemployment rate) = 101

Lebanon remains in the grips of financial, currency and political crises, with shortages of goods, the collapse of basic services and no fully functioning government. The weak parallel market exchange rate, an expected devaluation of the pegged exchange rate to the dollar, utility tariff hikes and subsidy cuts will spur inflation in 2023. The official unemployment rate according to the World Bank’s definition is forecast to be 14% next year, although actual labor market conditions will likely be considerably worse. The appointment of a government and the implementation of IMF-mandated reforms will be crucial to reducing the country’s misery index, but such a scenario remains a distant prospect.

“Inflation is expected to average […] amongst the highest rates globally, despite narrow money supply growth averaging 11 percent in 2022. This is primarily due to a change in the dynamic relationship between inflation and depreciation: the CPI exchange rate pass-through has averaged 134 per cent for 6M-2021, up from an average of 75 percent since the onset of the crisis, mainly on account of the reduced share of goods imported at BdL subsidized exchange rates.” – World Bank

- Argentina

2023 misery index: 91% (inflation rate) + 9% (unemployment rate) = 100

Argentina will continue to suffer next year from excruciatingly high inflation, a result of persistent currency depreciation and money printing. The currency weakened around 35% in the first 10 months of 2022, and our analysts see a depreciation of roughly 45% in 2023 as investors’ confidence in the peso remains non-existent. Moreover, an economic slowdown is expected to push up the unemployment rate in 2023, with lower commodity prices and weaker growth abroad weighing on momentum. In order to durably lower both inflation and unemployment, deep macroeconomic reforms are needed to remove the system of multiple exchange rates, reduce government interference in the economy, stimulate exports and investment, and end monetary financing of the fiscal deficit.

“Overall, despite extensive and broadening formal and informal price control mechanisms (including FX), high inflation is deeply entrenched and ingrained in price and wage formation mechanisms. This reflects deep structural macro policy imbalances and the failure of the monetary authority to instill confidence in the currency and thus generate low and stable inflation. Argentina has yet to develop a credible medium-term fiscal consolidation plan and lacks a coherent conventional monetary strategy/anchor.” – Sergio Armella, economist at Goldman Sachs

- Syria

2023 misery index: 63% (inflation rate) + 11% (unemployment rate) = 74

Syria’s economy has been ravaged by over a decade of civil war, which will continue to feed into elevated inflation and unemployment next year. International isolation, destroyed infrastructure, economic disruption caused by conflict, a limited supply of basic goods and a weak currency will all push up inflation, while the extremely poor business environment and low government spending will spur unemployment. That said, inflation should be around half its 2022 level in 2023, as international price pressures ease. More durable reductions in inflation and unemployment will require a more stable security situation, improved international ties and accelerated reconstruction efforts to boost the economy’s supply capacity.

“Instability will be particularly acute in 2022-23 owing to dire socioeconomic conditions and still-volatile pockets of resistance in the north-western and southern provinces. Mr Assad will try to offset the erosion of purchasing power by rapid inflation and currency depreciation by implementing price controls and shoring up foreign exchange, but his regime’s capacity to do so will be limited. Policymakers will attempt to revive the economy, but a lack of access to debt and ongoing bouts of conflict will hinder efforts.” – Economist Intelligence Unit

If you’d like more forecasts and analysis of over 200 countries and 30 commodities, download a sample report by clicking on the button below.