ARGENTINA

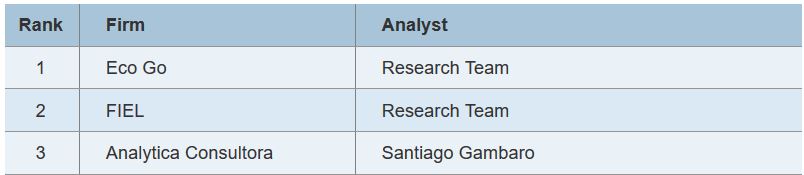

The research team at Eco Go topped the list as the most accurate Argentina forecaster of 2019, coming in ahead of the research team at FIEL and Santiago Gambaro at Analytica Consultora.

2019 was a grueling year for Argentina’s economy. In particular, August’s landslide presidential primary victory for Alberto Fernandez sent the peso, bonds and stocks tumbling in the largest simultaneous fall since the 2001 economic crisis. Over 2019 as a whole GDP contracted for the second straight year, while inflation remained excruciatingly high at over 50%—in significant part due to currency depreciation. The fiscal shortfall narrowed somewhat as the government implemented austerity measures, but remained sizeable.

“Argentina’s economy continued to suffer elevated instability last year, which makes the forecasting accuracy of Eco Go all the more impressive; they were the top-ranked forecaster for GDP, inflation and the policy rate”.

Massimo Bassetti, Argentina economist at FocusEconomics

BRAZIL

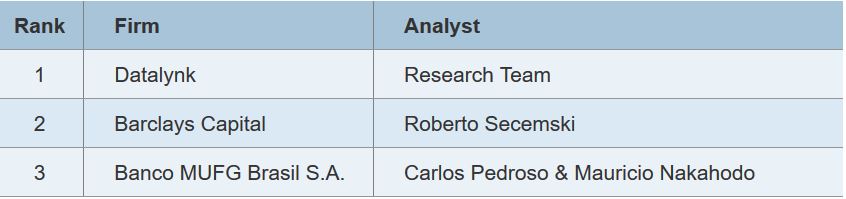

The research team at Datalynk was the most accurate Brazil forecaster of 2019, with Roberto Secemski at Barclays Capital and Carlos Pedroso and Mauricio Nakahodo at Banco MUFG Brasil S.A. in second and third place respectively.

Brazil’s economy stagnated yet again in 2019, with growth clocking a mere 1.1% and the unemployment rate remaining in double digits. The government imposed fiscal austerity, which saw the budget deficit pared back to a still-high 5.9%, while the Central Bank slashed rates in a bid to shore up activity. There were some more positive developments towards the end of the year: Parliament finally approved a landmark pension reform, improving debt sustainability, business confidence rose and bond yields fell. However, progress has now been truncated by Covid-19.

“Congratulations to Datalynk, who came out on top in a crowded field of roughly 50 panelists. Their forecasts for inflation and the exchange rate were particularly accurate”.

Javier Colato, Latin America economist at FocusEconomics

CHILE

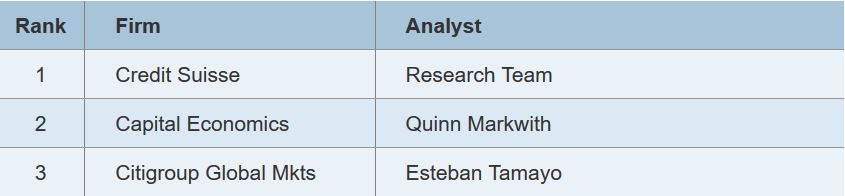

The research team at Credit Suisse was the most accurate Chile forecaster of 2019, coming ahead of Quinn Markwith at Capital Economics and Esteban Tamayo at Citigroup.

2019 was an extremely tumultuous year for Chile. The first three quarters were relatively calm, with the economy registering mild—if uninspiring—growth. However, the entire economic and political panorama was upended in October by devastating social unrest which damaged infrastructure, interrupted activity and shook confidence. In response, the government announced a marked loosening of the fiscal stance and constitutional reform.

“Navigating a year of such elevated economic uncertainty is tough for an economic forecaster, which makes Credit Suisse’s accuracy all the more noteworthy. Their forecasts for the exchange rate, fiscal balance and current account were particularly precise.”

Nicolas J. Aguilar, Chile economist at FocusEconomics

CHINA

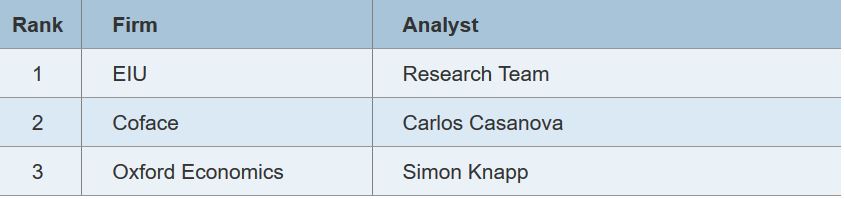

The research team at The EIU topped the list as the most accurate China forecaster in 2019, with Carlos Casanova at Coface and Simon Knapp at Oxford Economics clinching second and third place respectively.

2019 was a challenging year for China’s economy. The U.S.-China trade war scaled new heights amid several rounds of tit-for-tat tariffs. Social unrest erupted in Hong Kong, pushing its economy into recession and damaging its status as a hub for international finance. Moreover, a broader global growth slowdown posed problems for exporters.

The economy logged an expansion of just above 6% despite the external headwinds, although some sectors struggled. For instance, car sales declined notably, while industrial profits were weak. Trade-war fears saw the yuan depreciate notably against the USD, inflation rose due to African swine fever, and the fiscal deficit widened on weaker growth and stronger public spending.

“EIU’s accuracy was impressive; they came out on top in a tough field of the roughly 50 institutions covering the Chinese economy”.

Ricard Torné, China economist at FocusEconomics

EUROZONE

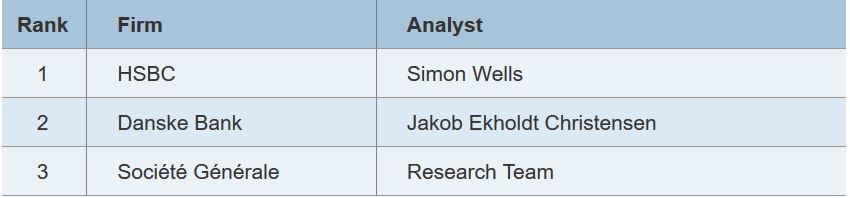

Simon Wells at HSBC was the most accurate Eurozone forecaster of 2019, ahead of Jakob Ekholdt Christensen at Danske Bank and the research team at Société Générale.

2019 was a subdued year for the Eurozone economy, in large part due to a weaker external sector amid trade war fears and slower growth abroad. However, resilient domestic dynamics—wage growth ticked up and unemployment fell—propped up activity.

The European Central Bank eased monetary policy in September in response to the dreary economic outlook, cutting rates and reactivating asset purchases.

“HSBC’s forecasts for GDP and the exchange rate were particularly accurate, which saw them beat off tough competition from more than 70 institutions”.

Jan Lammersen, Germany economist at FocusEconomics

GERMANY

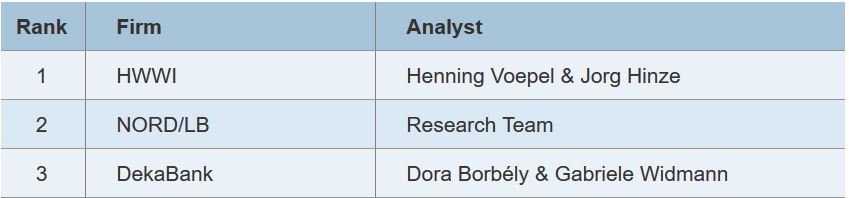

Henning Voepel and Jorg Hinze at HWWI were the most accurate Germany forecasters of 2019, ahead of the research team at NORD/LB and Dora Borbély & Gabriele Widmann from DekaBank.

Germany, Europe’s economic engine in recent years, spluttered in 2019. While domestic indicators such as unemployment, wages and consumption were broadly positive, the external sector was hindered by global trade tensions and weaker momentum abroad. This, coupled with a struggling car industry, saw industrial production decline over 3% in annual terms.

“HWWI’s projections were the most precise among the roughly 50 institutions covering the Germany economy”.

Jan Lammersen, Germany economist at FocusEconomics

JAPAN

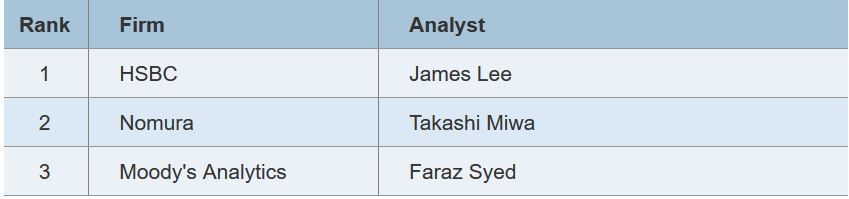

James Lee from HSBC was the most accurate Japan forecaster of 2019, ahead of Takashi Miwa at Nomura and Faraz Syed from Moody’s Analytics.

Japan’s economy saw another year of subdued momentum in 2019. The external sector suffered from the U.S.-China trade war and elevated global trade tensions more generally, while private consumption was knocked by the sales tax hike in October. However, the government’s supportive stance shored up activity somewhat. The Bank of Japan maintained its highly accommodative monetary policy of negative rates, due to weak growth and inflation well below the 2% target.

“HSBC prevailed in a tough field of the over 50 institutions covering Japan.”

Edward Gardner, Japan economist at FocusEconomics

MEXICO

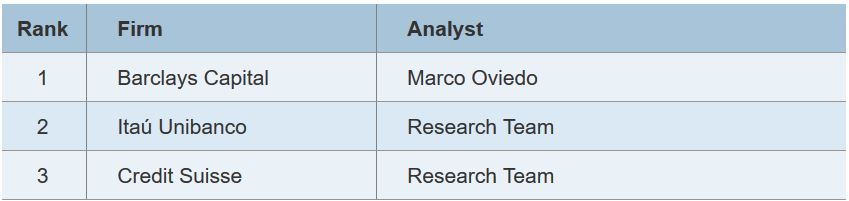

Marco Oviedo at Barclays Capital was the most accurate Mexico forecaster of 2019, coming in ahead of Itaú Unibanco and Credit Suisse.

2019 was a disappointing year for Mexico’s economy, which suffered a mild recession. Fixed investment and industrial production declined, while the government adopted a cautious budget stance amid its commitment to fiscal prudence. Even notable easing by Banxico could not jolt the economy into life. More positively, however, in December Mexico signed the USMCA trade deal along with the U.S. and Canada, providing some degree of certainty to the external sector and boding well for the investment climate.

“Barclays Capital held off stiff competition to take the top spot, and their forecasts for GDP and the current account were particularly on point”.

Javier Colato, Latin America economist at FocusEconomics

UNITED KINGDOM

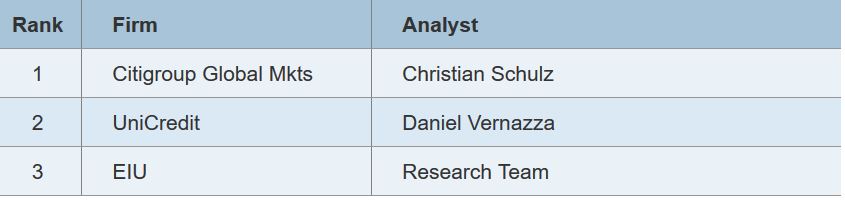

Christian Schulz at Citigroup was the most accurate UK economic forecaster in 2019, ahead of Daniel Vernazza at UniCredit and the research team at the EIU.

2019 was a turbulent year for the UK economy. The Brexit saga dragged on throughout the year, generating significant noise in economic data as firms adjusted their inventories in response to political developments. Underlying momentum was tepid though, as uncertainty hit investment and private consumption.

The lack of Brexit clarity and weak inflation led the Bank of England to stay on the sidelines. The pound was highly volatile due to Brexit, but ended the year up against the euro following the majority win for the Conservatives in the December general elections.

“Congratulations to Citigroup, who were able to see through Brexit-related volatility and provide highly accurate forecasts, coming out on top among close to 60 institutions”.

Oliver Reynolds, UK economist at FocusEconomics

UNITED STATES

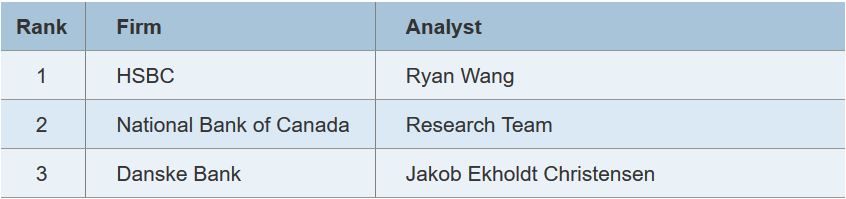

Ryan Wang at HSBC was the most accurate U.S. forecaster of 2019, holding off the research team at National Bank of Canada and Jakob Ekholdt Christensen at Danske Bank.

In 2019 the U.S. economy continued to markedly outpace its developed economy peers. Unemployment fell to a multi-decade low, spurring healthy wage growth and propelling consumer spending, while government consumption was also robust.

However, the escalation of the trade war with China—with both countries unleashing fresh waves of tariffs—hurt manufacturing, fixed investment and exports. Moreover, the budget deficit widened markedly despite above-potential economic growth, adding to concerns over long-term fiscal sustainability.

Monetary policy saw an abrupt volte-face. Analysts went into 2019 expecting further rate hikes; however, by the end of the year the Fed had cut rates by 75 basis points amid trade tensions and low inflation.

“HSBC pulled off an impressive feat, coming out on top among over 60 institutions covering the U.S. The forecasts for GDP, inflation and the fiscal balance were especially precise”.

Oliver Reynolds, Major Economies economist at FocusEconomics