The recent ten years have been a period of financial complexity for the American economy. For one part of the United States, wages have not grown at a pace reflecting the nation’s recovering macroeconomy. For another segment, the stock market, represented by either the Dow Jones Industrial Average (DJIA) or the S&P 500 Index, have show phenomenal growth that has made Wall Street and its investors extremely wealthy. But a problem that has remained silent is the increasing amount of corporate debt. Due to a number of key reasons, corporations have been extending their use of debt to keep not only creditors at bay but also to have happy shareholders. While the American economy is experiencing healthy growth, the real problem is what will happen to the macroeconomy if there is a unforeseen event or a sudden downturn that causes these corporations to renege on their loan obligations?

How much corporate debt is there?

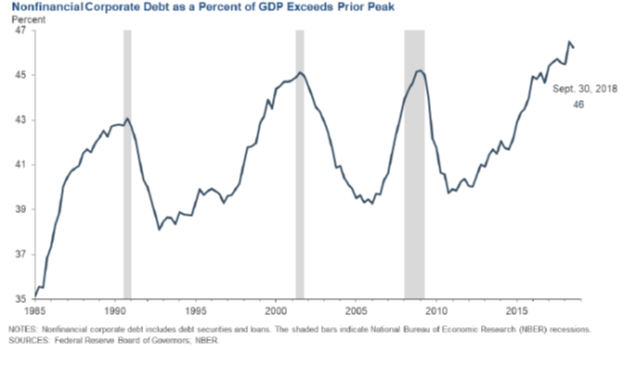

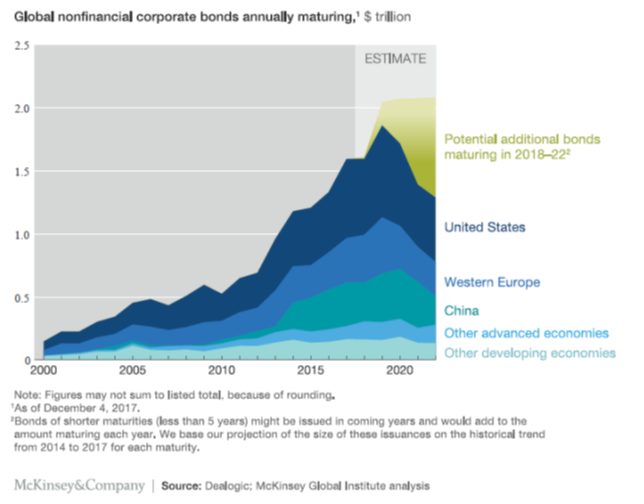

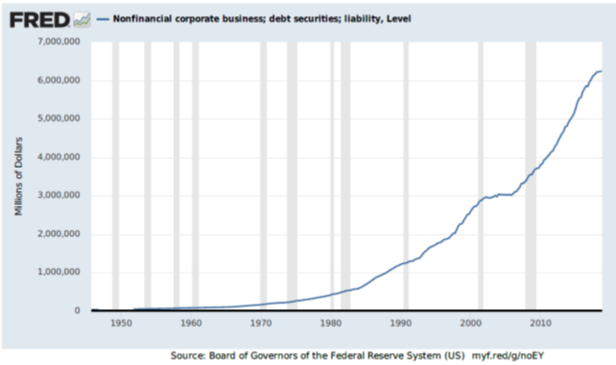

The amount of corporate debt has seen sizeable increases in the past ten years. In 2007, total corporate debt stood at approximately $4.9 trillion. But according to a report by McKinsey and Company, nonfinancial corporations total liabilities, including bonds and loans, grew by $37 trillion in reaching $66 trillion by mid-2017. However, with regards to other segments of debt, the value of corporate bonds outstanding from non-financial corporations has almost tripled to $11.7 trillion. With this increase in debt comes significant problems. For example, more companies are having difficulties meeting their debt obligations. According to the Institute of International Finance, Incorporated, a trade group representing financial institutions, approximately 17 percent of publicly-traded American corporations were having difficulties meeting interest obligations at the end of 2018 which is an increase from 2010 of less than 10 percent but lower than the high in 2016 which exceeded 20 percent.

From another financial perspective, the amount of corporate debt is seeing dangerous levels. According to S&P Global, the ratio of cash-to-debt for speculative-grade borrowers has gone to a ten-year low of 13 percent from 21 percent in 2010 and even below 15 percent in 2008 in the time of the Great Recession. S&P Global reached the conclusion that speculative borrowers are faced with debt of almost $8 for every $1 of cash. Even for higher rated debtor corporations that are investment grade, the cash-to-debt ratio is at a low of 21 percent or $5 of liabilities for every $1 of cash they hold. As long as the economy is stable and growing, this is not much of a problem. But if a recession were to occur, these corporations will face a severe debt crisis.

How it got this way

How it got this way

There are some key reasons in how the American corporate debt situation reached this stage. First, there is the economic growth of the United States since the Great Recession. With the American economy in much better shape than before, rating firms such as Moody’s and Standard and Poor’s have given companies such as CVS Health Corporation and Campbell Soup Company higher credit ratings which permits them to increase their debt load without diminishing their investment grade standings. These companies can attract new investors with the lure of good credit ratings and lower risk. The problem is that investors may be getting a false sense of security regarding the safety of their bond holdings. But with investment grade ratings, investors feel they are immune from any possible financial disasters and lend more than they should.

Another key reason is that interest rates have been at low levels since the period of the Great Recession. For example, according to Moody’s Seasoned Aaa corporate bond yield as of April 11th, 2019 the rate was 3.68 percent while on April 21st, 2014 the rate was 4.26 percent. According to the St. Louis branch of the Federal Reserve Bank, the 10-year high quality market corporate bond spot rate as of January 1st, 2019 was 4.15 percent while on January 1st, 2009 it was 6.87 percent. Currently, the average small business loan interest rate varies from 4 to 6 percent. Cheaper rates entice corporations, large or small, to borrow more even to the point of over-extending themselves.

Another problem is that even with the average quality of borrowers declining, the amount of debt is going up since lenders are enticed by higher interest rates. The problem the United States is experiencing is that 22 percent of outstanding non-financial corporate debt falls into the category of “junk” bonds while 40 percent have a rating of BBB which is one step above junk status. As of December 2018, the amount of BBB rated debt in the United States was approximately $2.5 trillion. The problem here is that these bonds while offering higher interest rates to bondholders have an above average chance of defaulting if the issuer hits bad financial times or if the macroeconomy enters a recession.

Another area of corporate debt that has seen significant growth are syndicated leveraged loans. Leveraged loans are made to companies experiencing a high amount of debt made by commercial banks and then sold or syndicated to nonbank investors. These investors purchase the loans and put them into special-purpose vehicles known as collateralized loan obligations (CLOs) as well as private equity funds. According to the Federal Reserve Bank of Dallas, the market size of syndicated leveraged loans has gone from $0.6 trillion in 2008 to $1.2 trillion at the end of 2018. These funds have been used as financial backing for corporate acquisitions and private-equity-backed transactions. The problem is that as these loans increase so may the chance of default in case of an economic downturn.

Benefits of debt

Despite the problems that debt may bring, there are some benefits for issuing companies.

- Diversification: Debt allows a corporation to diversify in how it acquires its financial capital. A corporation can offer bonds or borrow money from different sources and not be concerned about going to the same source for cash again and again. This is important since some potential lenders may not have enough money to lend or have stopped lending altogether. Also, a corporation can issue debt and not have to go to stockholders, either common or preferred, repeatedly to ask for additional cash.

- Reduced need for bank loans: A significant benefit for issuing debt, especially bonds or long-term notes, is that an issuing corporation does not need to approach commercial banks for funds. Not only does this help the borrowing corporation diversify its sources of financial capital, but also use banks as a backup source of financial capital for short and long-term loans. Issuing bonds or notes may also be a cheaper source of financial capital for corporations since the interest rate may be lower than a bank loan and have reduced costs.

- Sell bonds domestically or globally: A significant benefit for a corporation issuing debt, either bonds or notes, is that it can seek lenders domestically or globally. A corporation located in the United States can sell its bonds or notes anywhere in the country in order to diversify its investor base. But that same corporation can also go into foreign markets and attract international investors in its bonds and notes to further diversify its investor base. It also benefits these foreign investors so they can further diversify their portfolio. These foreign investors could also get a higher return on these bonds and notes than they possibly could in their own country. Finally, if the interest and principal are paid in American dollars, these foreign investors can obtain U.S. currency and minimize currency transaction costs.

- Acquire capital from finance companies: The issuance of bonds or notes can allow a corporation to acquire financial capital from finance companies. There are many finance companies, domestically and internationally, that will purchase bonds and notes and either hold them or sell them to clients. Selling bonds or notes to finance companies allows issuing corporations to diversify their investor base, possibly get lower interest rates on the debt, and issue debt at a lower cost.

- An annuity for investors: Issuing bonds can actually help investors such as private individuals who are looking for an annuity. Private investors who are in retirement age can purchase investment grade bonds offering greater safety than junk bonds or lower rated financial instruments. Not only do private individuals need bonds as an investment vehicle but also mutual funds, pensions, and insurance companies.

Key risk of debt

While debt issuance has its benefits for issuing corporations and investors, there are also risks. Foremost among these risks is that the issuing firm may be overextended. A significant problem for any corporation issuing debt is that it may overextend itself and issue too much. Due to lower interest rates, a healthy macroeconomy, and its high credit rating a corporation may go beyond the amount of debt it would normally raise. The problem here is that a corporation may have a difficult time repaying the debt if the economy takes a downturn or it may suffer financial problems it did not anticipate. But overextending their debt situation is an important concern that will not only affect the issuing corporation but also the debt holders as well as common and preferred shareholders.

What happens next?

As long as the American economy stays relatively healthy, then its corporate debt situation is sustainable. Corporations will be able to make their interest payments to lenders and these lenders will enjoy healthy cashflow into the foreseeable future. But if there is the long-awaited downturn in the macroeconomy or a black swan that suddenly appears causing the American economy to go into a recession, then these debt instruments could become worthless overnight and have a ripple effect that will be worse than has ever been experienced. This will result in pension funds missing payments to pensioners, mutual funds reducing or skipping interest payments to shareholders, and insurance annuities going bankrupt.

Arthur Guarino is an assistant professor in the Finance and Economics Department at Rutgers University Business School teaching courses in financial institutions and markets, corporate finance, investments, and financial statement analysis. The first half of his career was spent in the financial services industry working for corporations such as TIAA-CREF, Met Life, and The Bank of New York. He writes articles dealing with finance, economics, and public policy.

Arthur Guarino is an assistant professor in the Finance and Economics Department at Rutgers University Business School teaching courses in financial institutions and markets, corporate finance, investments, and financial statement analysis. The first half of his career was spent in the financial services industry working for corporations such as TIAA-CREF, Met Life, and The Bank of New York. He writes articles dealing with finance, economics, and public policy.

Sample Report

5-year economic forecasts on 30+ economic indicators for more than 130 countries & 30 commodities.