Individual forecasters’ projections for the pound next year vary quite drastically, and even more so as many scenarios are being considered.

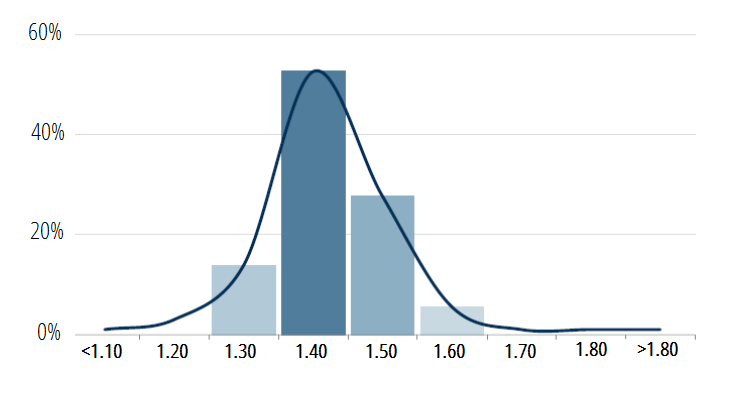

Our Consensus Forecast of 36 local and international UK analysts projects the pound to end 2019 at 1.38 USD per GBP. The maximum forecast is 1.59 USD per GBP while the minimum is significantly lower at 1.25.

USD per GBP 2019 | Distribution of Forecasts from 36 Analysts

For a more complete perspective of what may be in store for sterling in 2019, we spoke to several of our panelists:

Andrew Goodwin, Associate Director at Oxford Economics, comments:

“Brexit is pivotal to the outlook for sterling. Market pricing currently factors in some risk of a disorderly Brexit, so the resolution of the current impasse will push sterling in one direction or the other. Sterling looks oversold relative to valuation anchors so if Brexit proceeds in an “orderly” fashion, we would sterling to rebound strongly in 2019, reaching $1.39 by year-end. But if the UK departs the EU in disorderly fashion, sterling could fall by another 10% on a trade-weighted basis in 2019”.

According to Michael Ricards, Head of Europe Country Risk at Fitch Solutions:

“The trajectory of pound sterling is difficult to forecast for the coming twelve months. This reflects the unusually high level of political risk surrounding Brexit negotiations, which appear to have been the main drivers of the sterling since the vote to leave the EU in June 2016. We currently forecast the pound to be at USD1.41/GBP at end-2019, from a spot USD1.27/GBP. This is predicated on our core view, that despite elevated uncertainty, the UK will be forced into an even softer Brexit than the ‘Chequers’ plan withdrawal agreement tabled by the Conservative party.

Sterling would rally substantially as the option of a ‘no deal’ is removed. That said, the chances of the UK crashing out of the EU without a deal remain uncomfortably high. If it becomes clear that the UK will leave the EU without a deal on March 29, sterling would plunge. In such a scenario, we do not think that parity is out of the question. Given the wide variation in outcomes for sterling in both scenarios, forecasting the trajectory of the unit remains problematic.”

Andrew Wishart, UK economist at Capital Economics, says:

“Given the various ways in which Brexit could play out, and the implications for the pound, the current exchange rate is an average of where investors think the pound would go in various scenarios, weighted by their probability. […] Our central scenario is that the Government’s deal eventually passes. In this case, we think that the economy would gather pace in the transition period, and the Bank of England would hike rates three times in 2019 pushing sterling up to £1.45/$ by year end.

While this is the single most likely outcome, the probability of it is only about 30%. We ascribe a 20% chance to a no deal Brexit, which we think could cause the pound to fall as low as $1.12/£. The remaining 50% covers the range of outcomes that would require an article 50 extension, from “Norway for now” to a general election or second referendum. Given lingering uncertainty if article 50 were extended, we think that the pound could be trading anywhere between $1.25 and $1.40 at the end of 2019 in this scenario.”

In the view of Kallum Pickering, senior economist at Berenberg:

“Gilts, Sterling and domestic-oriented UK stocks are pricing in more downside than upside risk when it comes to Brexit. Keep in mind though, the risk that parliament may not pass a deal eventually is not insignificant (20% chance). As a result, markets probably will not rally on the initial agreement by UK-EU negotiators. That will probably only happen if and when the UK parliament passes a deal.

[…] [Assuming a deal is passed] we expect Sterling to gradually track upwards to a level that is in tune with the long-run economic outlook – below the pre-Brexit vote level but still above the European average (1.5%). Rising rates and better economic data will gradually push Sterling higher over the medium-term. By the end of 2019 we expect GBPUSD to rise to 1.39 (from c1.30 currently). In the long run, with potential annual growth of 1.5-1.7% (our Brexit base case) Sterling is probably undervalued on a tradeweighted basis by between 5% and 10%”.

Analysts at ING state:

“We continue to see the GBP proposition as quite binary, i.e. a virtuous circle of less risk premia and rising UK money market rates combining to deliver a positive outcome for GBP – or the vicious opposite. That said, we still think GBP is highly under-valued against the EUR, and we’re not looking for another 15-20% GBP decline in the event of a no-deal.”