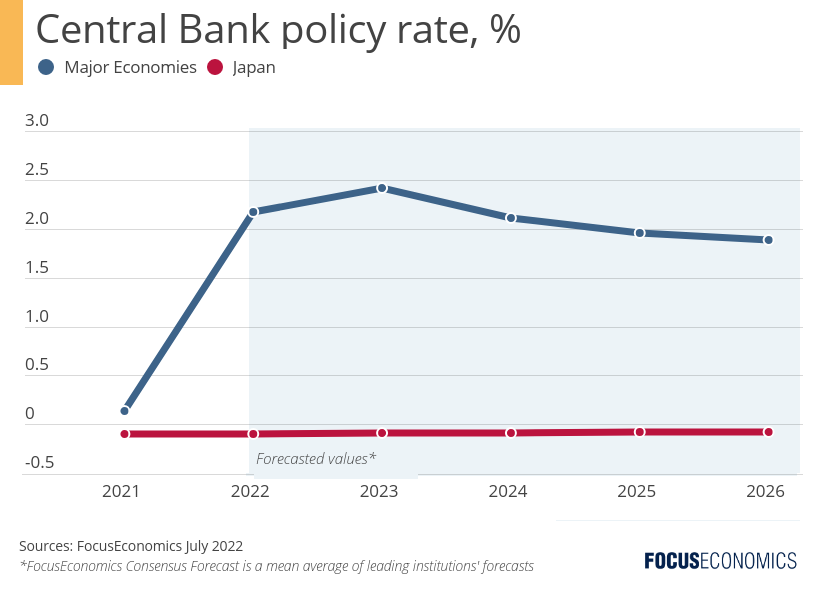

While developed markets around the world race to tighten their monetary stances in order to ward off the current bout of inflation, there is one economy charting a different course: Japan. Here, inflation is little over 2%, compared to over 8% in the U.S. and the Euro area. Mild inflation has reduced the urgency for the Bank of Japan to alter its policy of negative interest rates in place since 2016. In fact, our analysts expect Japan’s policy rate to remain negative over our forecast horizon to 2026. The upshot of the divergence between the monetary stances of Japan and its G7 peers has been a marked weakening in the yen, which has tumbled over 15% in year-to-date terms.

Notwithstanding costlier global food and energy, the country’s ingrained low inflation mindset and a lack of domestic demand are keeping price pressures muted. Soft demand is partly stemming from limp wages, which contracted year on year in April in real terms for instance. The rise in the number of part-time and contract workers to over a third of all jobs, and unions’ focus on job security over higher pay, are key drivers behind low wages. Moreover, demand is also being dampened by the aging and declining population, which shrank by over 300,000 in 2021 according to IMF data.

Prime Minister Kishida has made boosting wages a key policy priority. That said, his call for large firms to raise wages by 3% this year during the annual shuntō wage negotiations fell on deaf ears, with companies eventually agreeing a rise of a little over 2%. Looking ahead, wage growth is set to remain meek despite the government’s best efforts, due to the practice of negotiated annual pay hikes and a large pool of irregular workers. This will feed through to low inflation in turn—and a continued need for highly expansionary monetary policy. As such, Japan’s economic exceptionalism shows no sign of ending.

Insights from Our Analyst Network

On the outlook for inflation and interest rates, the EIU said:

“We maintain our forecast that consumer prices will rise by an average of 2.2% in 2022, before moderating to growth of 0.5% in 2023 as external factors such as surging commodity prices subside. The BOJ will maintain negative interest rates and quantitative easing to facilitate economic growth. However, it is possible that the central bank will adjust its yield curve control setting by allowing a wider band of movement for 10-year Japan government bond yields, from the current 0.25 percentage point, in order to reduce depreciatory pressure on the yen.”

On the monetary policy outlook, analysts at Nomura said:

“While there has been speculation that the BOJ might move to normalize its monetary policy program due to widening gaps in interest rates between Japan and other countries (and the resulting downward pressure on the value of the yen), we expect such speculation to die down eventually. At the time of the BOJ’s monetary policy meeting in June, we had put the probability of adjustments to monetary policy before the end of 2022 at about 10%, but we now put the probability at only 5%.”