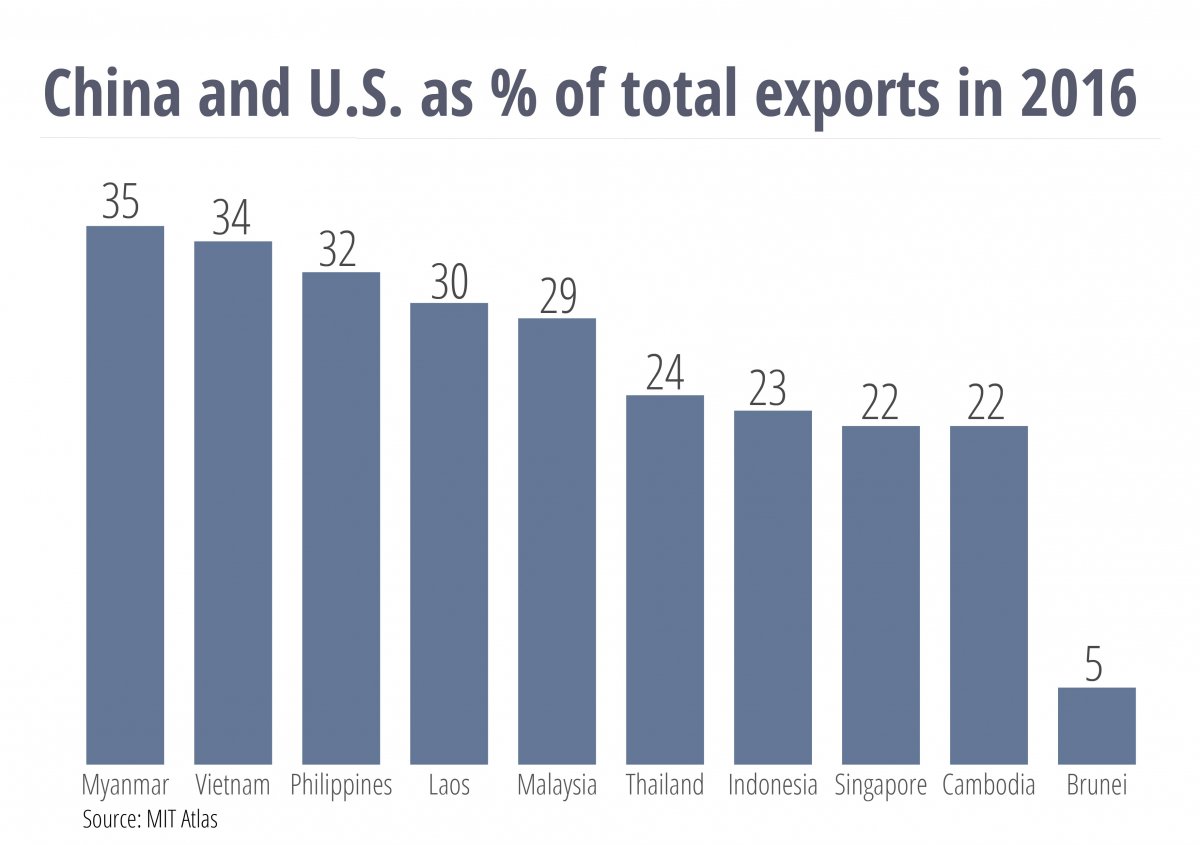

Reciprocal blanket tariffs would almost certainly shave several decimals off growth in both countries and dampen global economic activity. This spells bad news for the more export-dependent ASEAN economies, such as Singapore, Vietnam, Malaysia and Thailand. Of these four economies, Vietnam and Malaysia export the most to the U.S. and China as a percent of total exports, potentially making them more exposed. In addition, Singapore, Malaysia and Thailand have sizeable manufacturing sectors, highly integrated into global value chains which would be severely disrupted by tariffs.

However, this doesn’t tell us the whole story. Although Indonesia and the Philippines—by nature of their huge domestic markets—are less export-oriented, they are more exposed to the likely financial market fallout from a full-fledged trade war. Due to their weak current account positions, both countries could experience capital outflows and sharp currency depreciations. This tendency has already been observed so far in 2018, with the rupiah and the peso losing substantial ground against the dollar on rising economic uncertainty. This could necessitate even higher interest rates in these countries, dampening economic growth.

However, it isn’t all doom and gloom. The impact on ASEAN’s smaller countries should be mild, given that they are less plugged into the global economy. In particular, Brunei—which has extremely low exposure to the U.S. and China and relies heavily on Japan—appears well shielded.

The U.S.-China tariffs could even offer certain upsides to ASEAN. In particular, some companies based in China could move more manufacturing operations to ASEAN countries to circumvent tariffs. Possible beneficiaries include Malaysia’s chemical industry and Vietnam’s consumer goods sector. Plus, Chinese tariffs on U.S. primary products could help Thai fruit exporters and Myanmar cattle owners grab a larger slice of the Asian giant’s market.

But despite these silver linings, the impact of a trade war on ASEAN will still be resoundingly negative. In a now-infamous tweet, President Donald Trump once remarked that “trade wars are good, and easy to win”. Few ASEAN countries are likely to share his enthusiasm.

Sample Report

5-year economic forecasts on 30+ economic indicators for 127 countries & 33 commodities.