Baseline outlook and forecast risks

Persistent current account deficits (exceeding 5% of GDP in 2017-2018), growing investor concerns about the impact on emerging markets of rising US interest rates, a general distrust of President Erdogan’s expansionary fiscal policy, together with the growing tensions between the US and Turkey, have all contributed to the recent currency collapse and rising interest rates. The central bank is likely to respond with further interest rate increases bringing its key interest rate close to 20% by the end of 2018. In combination with the lira’s depreciation and significant corporate foreign currency debt, this is likely to contribute to a large increase in business defaults and the proportion of non-performing bank loans, endangering Turkey’s banking sector.

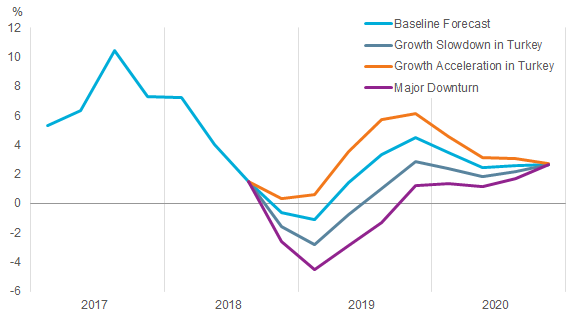

Turkey Real GDP Growth under Alternative Scenarios: 2017-2020

Source: Euromonitor International’s Macro Model

Note: Data for Q2 2018 onwards is forecast. Scenarios start date is Q4 2018.

Tighter credit conditions and falling private sector confidence are likely to push Turkey’s economy into a contraction at the end of 2018. We have reduced our baseline forecast for Turkey’s GDP growth to 2.5-3.5 in 2018, followed by 1.3-2.7% GDP growth in 2019. We assign this baseline forecast a 20-30% probability over a 1-year horizon.

This baseline forecast is surrounded by major uncertainty. A worsening of the recent sell-off in Turkish financial markets and stronger declines in private sector sentiment would lead to a sharper growth slowdown, with GDP growth of -0.6% to 0.8% in 2019 (15-25% estimated probability over a 1-year horizon), or a more severe downturn with GDP contracting by 1.2-2.6% in 2019 (10-20% estimated probability over a 1-year horizon). On the upside, a diffusion of the current tensions with the US, and a positive investor response to the government’s medium-term fiscal programme to be presented in September, could boost confidence and reduce interest rates. Under this growth acceleration scenario, GDP growth could rise to 3.3-4.7% in 2019 (15-25% estimated probability over a 1-year horizon).

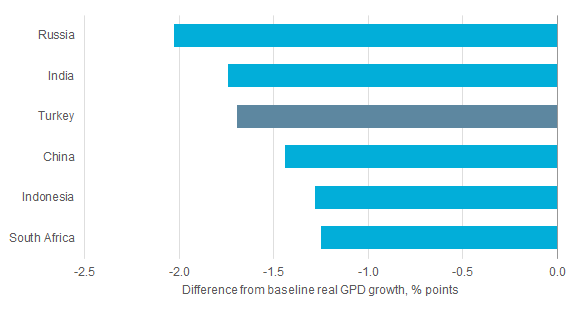

Contagion risks are limited

Spill-over risks from Turkey’s current currency crisis are modest. Most of Turkey’s government debt is domestically held, as is 80% of Turkey’s stock market, which only accounts for 0.5% of the MSCI Emerging Markets Index’ value. The exposure of Eurozone banks’ to Turkish assets represents less than 1% of GDP, with the exception of Spain where they represent 5-6% of GDP. There were some signs of Emerging Markets contagion in August, with a significant depreciation in the South African Rand and a worsening of the Argentine Peso’s depreciation. However, these countries already had significant previous vulnerabilities, with Argentina already in trouble before the recent Turkish lira crash. Outside of these isolated cases there are no strong signs of contagion. Nevertheless an Emerging Markets slowdown remains one of the main risks for the global economy for 2018-2019, potentially reducing annual GDP growth in Emerging Markets by 1-3% over a 3-year horizon. We currently assign this scenario an 8-13% probability over a 1-year horizon.

Emerging Markets Slowdown: 3-Year Average Annual GDP Impact

Source: Euromonitor International’s Macro Model

Note: GDP impact is calculated as a difference between the baseline and scenario real GDP growth, expressed as an average annual difference during the first 3 years after the scenario start date.

For further enquiries, please contact Daniel Solomon, Economist, at Daniel.Solomon@euromonitor.com.

About the Author

Daniel Solomon joined Euromonitor International in 2011 and is responsible for macro-economic modelling and analysis. His areas of expertise include business cycles, financial markets and the macroeconomy, dynamic general equilibrium models and applied macro econometrics. Daniel holds a Master of Science in Management/Finance from Queen’s University – Queen’s School of Business, Canada, a Master of Arts in Economics from McGill University, Canada and a Ph.D. in Economics from the Université de Montréal, Canada.

Euromonitor International is the world’s leading independent provider of strategic market research. With 15 offices around the world and in-country analysts in over 100 countries, Euromonitor International provides statistics, analysis and reports, as well as breaking news on industries, economies and consumers worldwide. We connect market research to your company goals and annual planning by analysing market context, competitor insight and future trends impacting businesses worldwide.

Sample Report

5-year economic forecasts on 30+ economic indicators for 127 countries & 30 commodities.