- Brent Crude Outlook

Oil prices were extremely elevated over the last month as Canada, the UK and the U.S. announced bans on Russian oil imports. Meanwhile, tough EU sanctions—including a total ban—on Russian oil have become more probable. In its latest April report, the IEA estimated that the hit to Russian output from sanctions and self-sanctions would be around 13% in April and double that in May. Meanwhile, OPEC+ refused to speed up its output increases at its latest meeting on 31 March. That said, the U.S.’s pledge of the largest oil reserve release in its history—although unlikely to fully compensate for the hit to Russian supply—has provided some downward pressure, with the IEA later promising a further oil release in concert. Moreover, demand headwinds have strengthened: In its April report the IEA lowered its forecast for global demand in Q2 amid a Covid-19 outbreak in China and the effect of rising inflation on consumption in OECD countries.

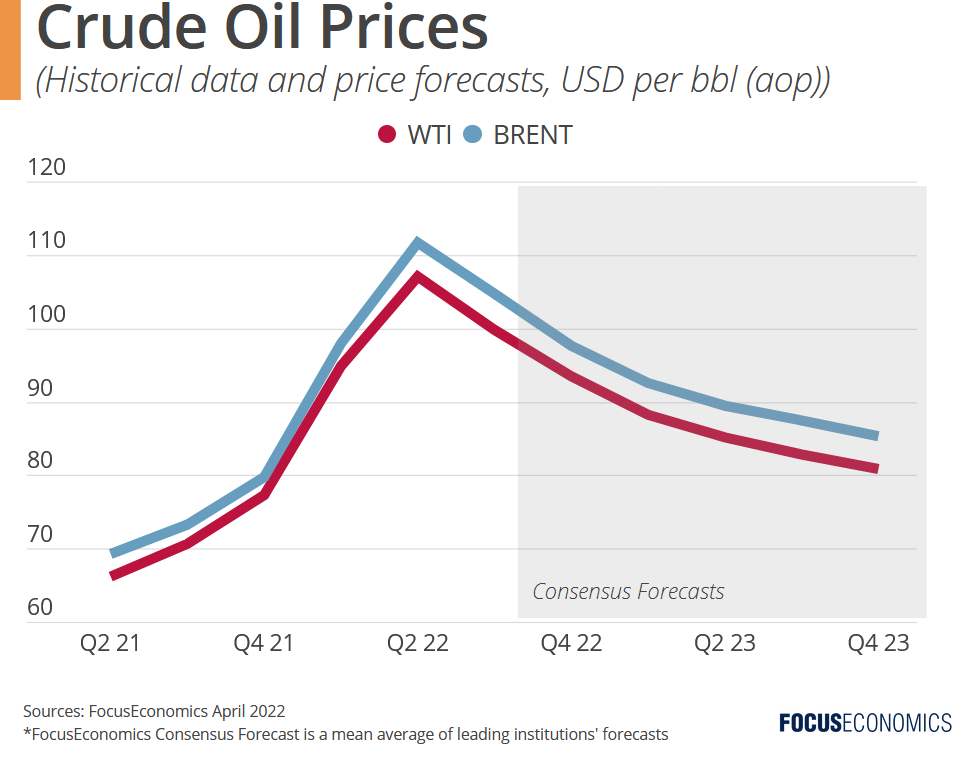

Our Consensus Forecast expects Brent prices to fall by year-end from March’s average prices, amid easing economic momentum and rising inventories. However, prices will remain at the highest levels in nearly a decade. The market remains illiquid and thus highly volatile, with significant risks being posed by the evolution of the war in Ukraine, possible EU sanctions and a strengthening of demand headwinds.

- Henry Hub Natural Gas Outlook

Henry Hub gas prices have continued to perform strongly over the last month. Supply remains tight, with the EIA’s latest monthly Energy Outlook report published on 12 April indicating that U.S. gas inventories ended March 17% below their five-year average. Moreover, freeze-offs caused production to dip to the lowest level since February in early April. Near-term domestic demand prospects have also been boosted by forecasts of cold weather across parts of the U.S. going into April. Meanwhile, U.S. exports continue to operate at full capacity, with the U.S. recently penning a deal with the EU to supply it with natural gas. That said, U.S. gas prices remains relatively insulated from the fallout of the Russia-Ukraine war, given plentiful U.S. gas reserves.

Our Consensus Forecast expects Henry Hub prices to fall by year-end from March’s average prices amid stronger U.S. supply. However, prices will remain substantially above their long-run average amid record LNG exports. The market remains volatile and risks exist in both directions, which include potential EU sanctions on Russia gas and the weather.

- Coking & Thermal Coal Outlook

In March, prices for Australian thermal coal briefly doubled following the first announcement of Western sanctions on Russian energy exports, with coking coal prices posting similarly impressive gains. Prices have since softened as market panic eased amid extremely high trading volatility. That said, prices remained at historically high levels. Factors underpinning the market include extremely high oil and gas prices, which could reignite Western countries’ appetite for coal, and Western energy sanctions. Meanwhile, production in Australia continued to be constrained by wet weather—which is set to continue until May—and Covid-19-related worker absences.

Our Consensus Forecast expects both coking coal and thermal coal prices to fall substantially by year-end from March’s average prices amid reduced disruptions to Australian supply and softening demand amid reduced global economic momentum. Market volatility remains elevated and swings in either direction may occur due to events such as an escalation of the war in Ukraine or China easing its ban on Australian coal.

- Uranium

Prices over the last month have hit levels not seen since immediately after the March 2011 Fukushima accident. High oil and gas prices have boosted demand prospects as nuclear power is a substitute of theirs which—unlike coal—promises to help countries meet Paris Agreement obligations. Meanwhile, the short-term supply outlook appears strained: Some Western companies have shunned uranium from Russia while U.S. senators recently introduced a bipartisan bill to ban imports of the metal from Russia.

Our Consensus Forecast expects uranium prices to fall by year-end from March’s average prices. However, they will remain comfortably above next year’s prices amid robust demand stemming from green transition plans and Western efforts to wean themselves off Russian energy. Risks include the path of Western sanctions on Russian energy, supplier discipline and potential nuclear disasters deterring future demand.