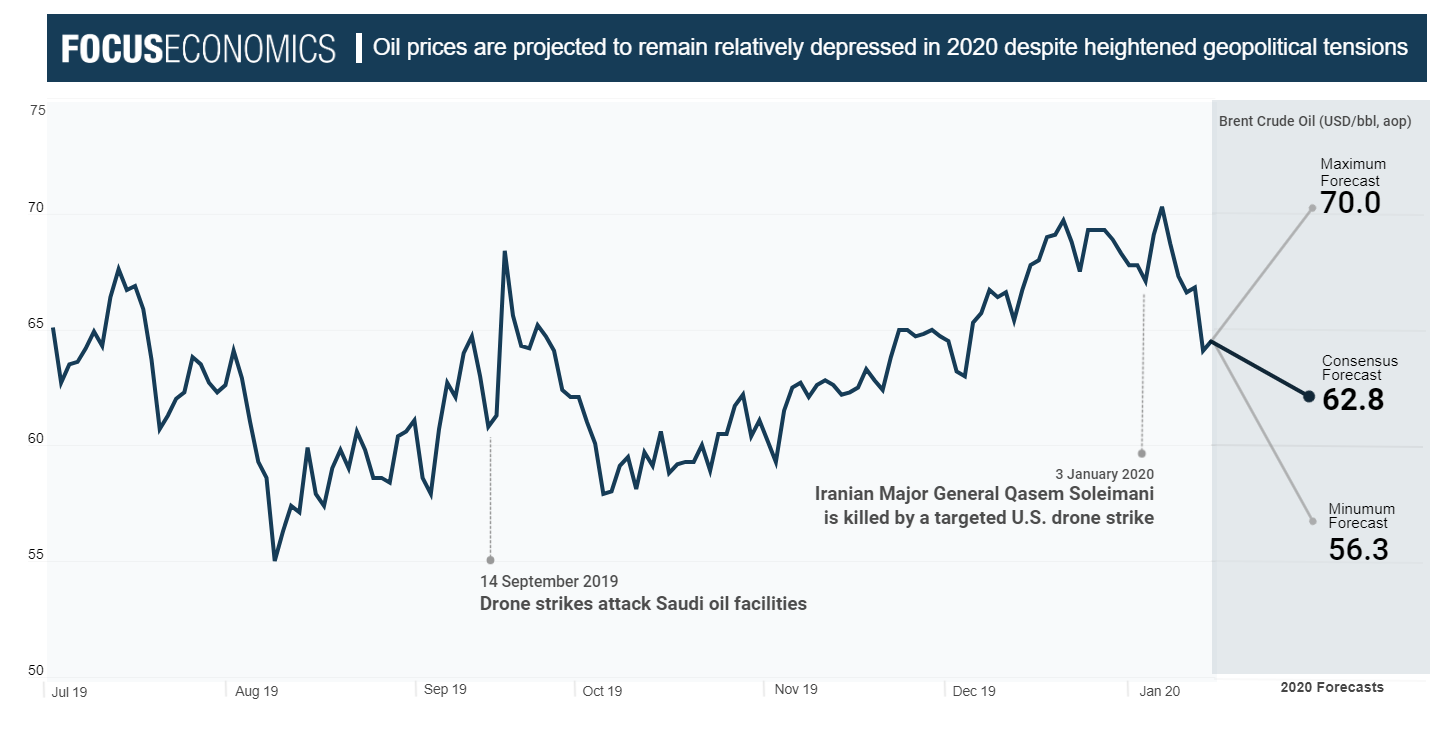

Once again demonstrating the volatility of the region’s most precious commodity and economic lifeblood, oil prices jumped at the start of the month on news that Iranian Major General Qasem Soleimani had been killed by a targeted U.S. drone strike. In anticipation of a retaliation from Iran, which materialized on 8 January in the form of a series of ballistic missiles fired at two U.S. military bases in Iraq, crude oil prices climbed above the USD 70-barrel mark and hit an over seven-month high.

Prices subsequently rapidly retreated as the risk of a full-scale conflict between the U.S. and Iran faded. President Trump’s speech on the day of the Iranian retaliation further alleviated these fears; crucially, no one was killed by Iran’s response, with many analysts suggesting the strikes were deliberately intended to avoid casualties—and thus a direct confrontation with the U.S.—but allowing the regime to save face nonetheless. Moreover, no oil supplies were compromised and oil shipments through the Strait of Hormuz remained largely unaffected, while Saudi Arabia and the UAE—Washington’s key allies within the cartel—were expected to boost production if necessary, despite OPEC+’s commitment in December to implement deeper cuts.

Looking ahead, oil prices are expected to remain relatively suppressed this year due to ample supply—and despite the recent extension of the OPEC+ oil cut deal, heightened geopolitical tensions and the recent signing of the “phase one” trade deal. FocusEconomics panelists see prices averaging USD 62.8 per barrel in 2020.

Nevertheless, the recent episode once again highlights how oil prices still remain sensitive to developments in the region. Oil prices last spiked in mid-September, when drone strikes—which the U.S. blamed on Iran—closed over one-half of Saudi Arabia’s oil production, the largest disruption to the global oil supply in history. Another attack on Saudi oil facilities would thus be bound to stoke prices, as would any disruption to the Strait of Hormuz, through which around 30% of the world’s seaborne shipments pass each day.Once again demonstrating the volatility of the region’s most precious commodity and economic lifeblood, oil prices jumped at the start of the month on news that Iranian Major General Qasem Soleimani had been killed by a targeted U.S. drone strike. In anticipation of a retaliation from Iran, which materialized on 8 January in the form of a series of ballistic missiles fired at two U.S. military bases in Iraq, crude oil prices climbed above the USD 70-barrel mark and hit an over seven-month high.