Background: Italian Economic Stagnation and a Political Class without Any Clear Solutions

The new government formed after lengthy negotiations, following the March 4th legislative elections in which M5S got 32.7% of the votes, while the League got 17.4% of the vote. Together they barely have 50% of the popular vote, but due to Italy’s mix of proportional representation and first past the post system, the joint M5S-League coalition has 352 out of 630 seats in the Chamber of Deputies and 170 out of 321 Senate seats. Meanwhile, the more centrist Democratic Party (the main party in the previous government) and Forza Italia (Silvio Berlusconi’s party) suffered major losses.

The initial coalition proposal was rejected by Italian President Sergio Matarella, due to its inclusion of a strongly anti-Euro finance minister. This led to concerns in financial markets about a new election as early as July 2018, in which M5S and the League were likely to win an even stronger majority. However, in the end MS5 and the League came to a coalition agreement without the controversial Eurosceptic finance ministry candidate.

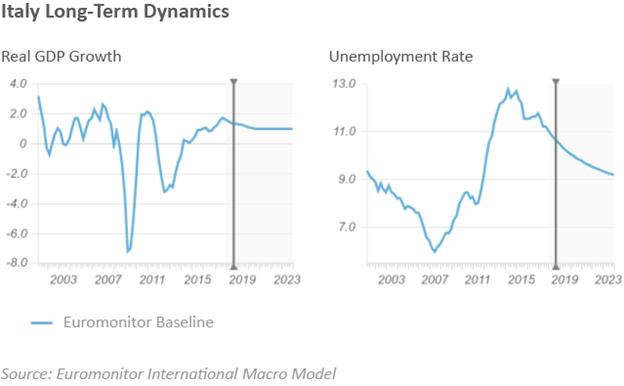

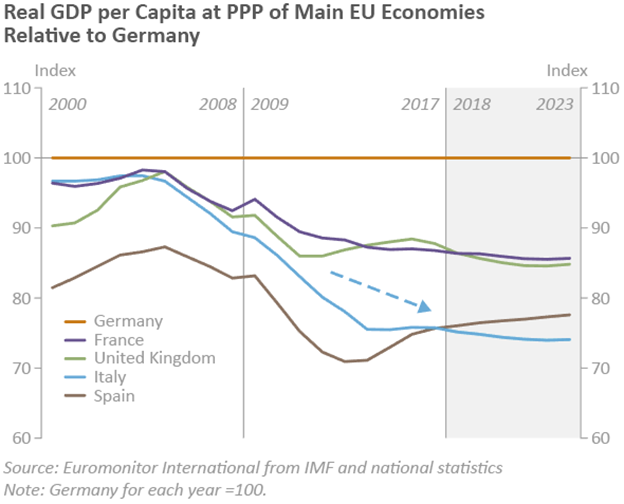

The main cause of the political dissatisfaction leading up to the new coalition is a prolonged economic stagnation, which started well before the 2008 Global Financial Crisis (GFC). Italian real GDP per capita is now below its level 20 years ago, before the Eurozone was launched. In comparison, other major European economies have continued becoming richer, though at a slow pace by historical standards.

Italy’s abysmal economic performance in the last 20 years reflects several factors:

- Dysfunctional legal and political institutions: high levels of corruption, inefficient administration and business laws, excessive regulations for e.g. starting a new business.

- Lower penetration of computers and other information and communication technologies (ICT), combined with greater prevalence of corporate management practices that discourage higher adoption of ICT and other productivity improvements.

- Relatively low education levels of the workforce: the quality of secondary education is below the OECD average, a significantly above average proportion of adults have low literacy or numeracy levels, and the proportion of adults with University education is much lower than the OECD average.

- A credit boom in 2001-2007 that directed more funds to sectors with lower productivity but higher access to the financial system, leading to misallocation of capital and other production inputs.

European Commission analysis of structural reforms suggests that if Italy had successfully closed around half of its structural gaps relative to best practice among EU countries, it would have boosted its GDP per capita in the last 20 years by 16%.

Various governments in the past 20 years have failed to solve these problems due to a mixture of unwillingness to confront special interests, corruption, and the sheer complexity of major economic reforms.

The New Coalition’s Economic Programme: Fiscal Stimulus but with Potential for Financial Crisis

The new coalition’s economic programme does not offer any solutions to these deep structural problems. Instead, coalition plans include spending increases and tax cuts worth 6-7% of GDP annually. Key elements of the new government’s economic programme include the following:

- Persons below a certain income will get 780 Euros basic monthly income from the government. The minimum monthly pension will also increase to 780 Euros.

- The current income tax will be replaced by a flatter structure, with 15% and 20% rates, in addition to a 3000 Euros annual deduction for families.

- Planned increases in consumption taxes worth 12.5 billion Euros will be abandoned.

- Plans to gradually raise the retirement age will be dropped.

- Reform of Eurozone institutions, in particular a loosening of the current Stability and Growth pact that limits budget deficits to 3% of GDP.

On the surface, these plans amount to a massive fiscal stimulus. However, given the large amount of Italian government debt (now exceeding 130% of GDP) and Italy’s already high borrowing costs, the positive multiplier effect on GDP growth is likely to be much lower than in typical fiscal stimulus episodes. The impact on GDP would be close to zero in our baseline outlook, after factoring in the negative impact on financial markets and business confidence.

Italian borrowing costs spiked during the coalition formation process, on fears of a new election leading to an even stronger populist majority, and the negative impact of a populist fiscal programme on Italy’s high debt levels. The spread between Italian and German government 10-year bond yields reached 2.9% on May 29th, just before the new coalition was approved, compared to 1.4% in January 2018. It is still at 2.3% in mid-June.

Uncertainty and Downside Risks Have Increased

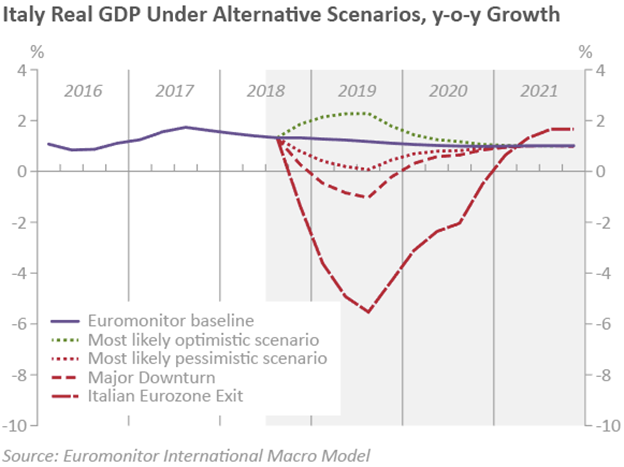

In our baseline forecast Italy’s economy expands by 1.1-1.7% in 2018 and by 0.8-1.6% in 2019. This assumes debt market turbulence is contained, with positive fiscal stimulus effects compensating for the higher costs of borrowing in Italy. We assign the baseline scenario a 20-25% probability.

On the upside, fiscal stimulus effects could dominate, leading to GDP growth of 1.2-1.8% in 2018 and 1.7-2.5% in 2019. We assign this most likely optimistic scenario a 15-25% probability.

On the downside, further increases in Italian borrowing costs could lead to a slowdown, with GDP growth declining to 1-1.6% in 2018 and 0-0.7% in 2019. We assign this most likely pessimistic scenario a 15-25% probability. A more significant spike in Italian bond yields could lead to a more severe downturn, with GDP contracting by 0.2-1% in 2019. We assign the major downturn scenario a 10-20% probability.

What about Italexit Risks?

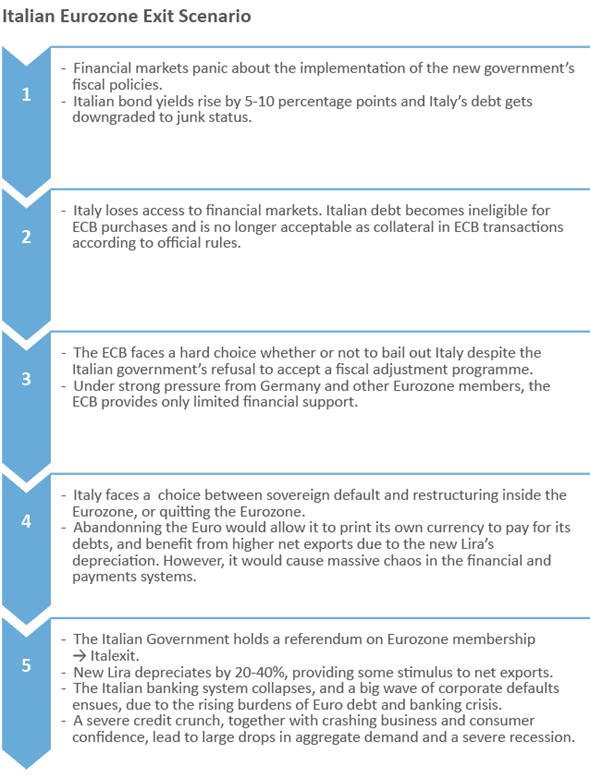

The new Prime Minister Giuseppe Conte has reiterated that the new government will not hold a referendum on Eurozone membership. However, the current loose fiscal policy plans of the coalition puts it on a collision course with financial markets that could ultimately force a Eurozone exit. The dynamics of this Italexit scenario have some similarity to earlier Grexit scenarios from the summer 2015, but on a much larger scale.

There are several factors that are likely to prevent a default on Italian debt or Italexit:

- Around two thirds of Italian government debt is domestically held. Any default or significant restructuring will mainly hurt Italian banks and households holding government bonds. The coalition is unlikely to take actions that directly lead to such an own-goal.

- The government’s budget needs approval from both houses of parliament, and the coalition’s majority in the Senate is weaker, potentially disappearing under threat of a crisis.

- The Italian constitution states that the government must ensure a balanced budget over some horizon and guarantee the sustainability of its debt. A budget that imposes an excessively high deficit could be deemed unconstitutional and blocked by Italian President Matarella.

In a crisis situation, these factors may cause a scaling back of the current fiscal plans, a breakdown in the current coalition, or a constitutional crisis that would raise political uncertainty but avoid an Italexit. Nevertheless, the estimated probability of an Italexit over a 1-year horizon has increased from 0-5% in April to 5-15% in June.

Spill-overs from Italy to the rest of the Eurozone are likely to be moderate, even under an Italexit scenario. This reflects a reduced exposure of other European banks to Italian debt after the 2011-2014 Eurozone Crisis, and better tools at the ECB for handling financial market shocks. Nevertheless, some financial contagion risks remain. We have increased the probabilities of a Eurozone recession scenario from 4-9% to 5-10% at a 1-year horizon.

For further enquiries, please contact Daniel Solomon, Economist, at Daniel.Solomon@euromonitor.com.

About the Author

Daniel Solomon joined Euromonitor International in 2011 and is responsible for macro-economic modelling and analysis. His areas of expertise include business cycles, financial markets and the macroeconomy, dynamic general equilibrium models and applied macro econometrics. Daniel holds a Master of Science in Management/Finance from Queen’s University – Queen’s School of Business, Canada, a Master of Arts in Economics from McGill University, Canada and a Ph.D. in Economics from the Université de Montréal, Canada.

Euromonitor International is the world’s leading independent provider of strategic market research. With 15 offices around the world and in-country analysts in over 100 countries, Euromonitor International provides statistics, analysis and reports, as well as breaking news on industries, economies and consumers worldwide. We connect market research to your company goals and annual planning by analysing market context, competitor insight and future trends impacting businesses worldwide.

Sample Report

5-year economic forecasts on 30+ economic indicators for 127 countries & 30 commodities.